atmsmshr

Full time employment: Posting here.

Ok – I finally did it. Turned in my retirement notice last week after working 33 years at the same power plant (A rare feat these days). Gave 30 days’ notice followed by 30 days’ vacation to give time for turnover if succession planning is implemented (not my problem). Up to the point of turning in my letter it felt like it was jumping out of a perfectly good airplane with a chute that I had never before packed. Next day, the birds sang more, the sun shone brighter, and I knew it was the right time. HR wanted an announcement. Congratulations and disbelief were the expressions from coworkers, some of whom exclaimed that I was not old enough. To them I worriedly asked if there was a minimum age to retire. Others asked what other contractor or company would I be headed to next? Clearly, these are the unlucky or the short sighted.

Stayed true to our life goal of not moving during my career while DW and I raised a family in a beautiful part of Florida by deliberately turning down several promotions (and inevitable relocations down the road) and polite demurral from taking corporate positions.

The timing was right: got grandfathered full retiree medical in March, paid off SS taxes in April (with 35 years wages), and in May the CEO announced no Early Retirement Packages this year. DW had a car accident in February and I just got through a health scare – these events coupled with recent deaths of coworkers brought home the reality that life is finite. DW is disabled, so we already know that good health is finite.

Am deeply grateful for this forum – has been a wealth of experience of teaching in the home stretch to FIRE – and for providing a great source of references on retirement so I could form opinions and make informed choices. You have also forecasted my FIRE anxieties, which helped me process them more logically. Otherwise, I might have felt more like Binkley from Bloom County looking at a Snorklewacker coming out of the closet every night.

Here were/are some of my bigger anxieties – What were yours?

At 58, did we retire too early or too late? (Also known as – have we saved enough?)

Corollary- Is it a mistake to turn off this fabulous paycheck (knowing I can’t go back)?

What is our expiration date, and when will decent health be forever gone?

DS and DD are doing great for now, but will some event send them home?

Is the next great recession just around the corner bringing on the dreaded SORR apocalypse?

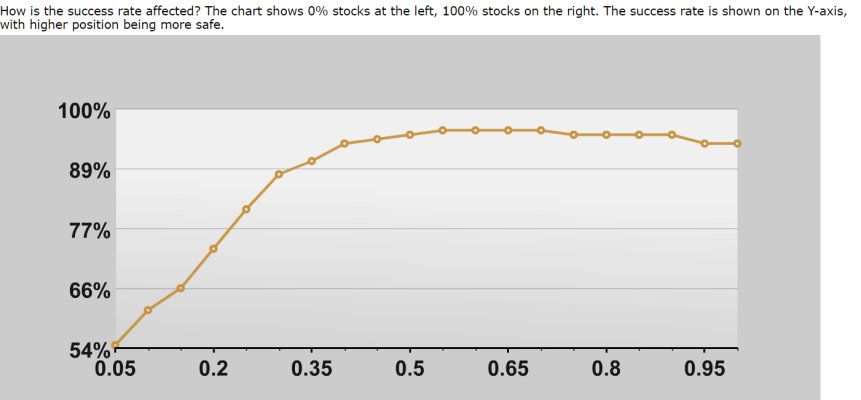

What is the best AA for us in retirement (currently conservative)?

Will our marriage become more or less fulfilling (pretty darned good after 31 years)?

Do we really know our own bucket lists at this point or will they change?

For the men only – why did god give us prostates and why the heck does mine feel the size of a Georgia peach sometimes?

Regards - atom

Stayed true to our life goal of not moving during my career while DW and I raised a family in a beautiful part of Florida by deliberately turning down several promotions (and inevitable relocations down the road) and polite demurral from taking corporate positions.

The timing was right: got grandfathered full retiree medical in March, paid off SS taxes in April (with 35 years wages), and in May the CEO announced no Early Retirement Packages this year. DW had a car accident in February and I just got through a health scare – these events coupled with recent deaths of coworkers brought home the reality that life is finite. DW is disabled, so we already know that good health is finite.

Am deeply grateful for this forum – has been a wealth of experience of teaching in the home stretch to FIRE – and for providing a great source of references on retirement so I could form opinions and make informed choices. You have also forecasted my FIRE anxieties, which helped me process them more logically. Otherwise, I might have felt more like Binkley from Bloom County looking at a Snorklewacker coming out of the closet every night.

Here were/are some of my bigger anxieties – What were yours?

At 58, did we retire too early or too late? (Also known as – have we saved enough?)

Corollary- Is it a mistake to turn off this fabulous paycheck (knowing I can’t go back)?

What is our expiration date, and when will decent health be forever gone?

DS and DD are doing great for now, but will some event send them home?

Is the next great recession just around the corner bringing on the dreaded SORR apocalypse?

What is the best AA for us in retirement (currently conservative)?

Will our marriage become more or less fulfilling (pretty darned good after 31 years)?

Do we really know our own bucket lists at this point or will they change?

For the men only – why did god give us prostates and why the heck does mine feel the size of a Georgia peach sometimes?

Regards - atom

Last edited: