Same here - I developed ours over the course of a couple of years, and didn't do it with re-use/sharing in mind..

Key things I'd recommend if you're going to build your own would include:

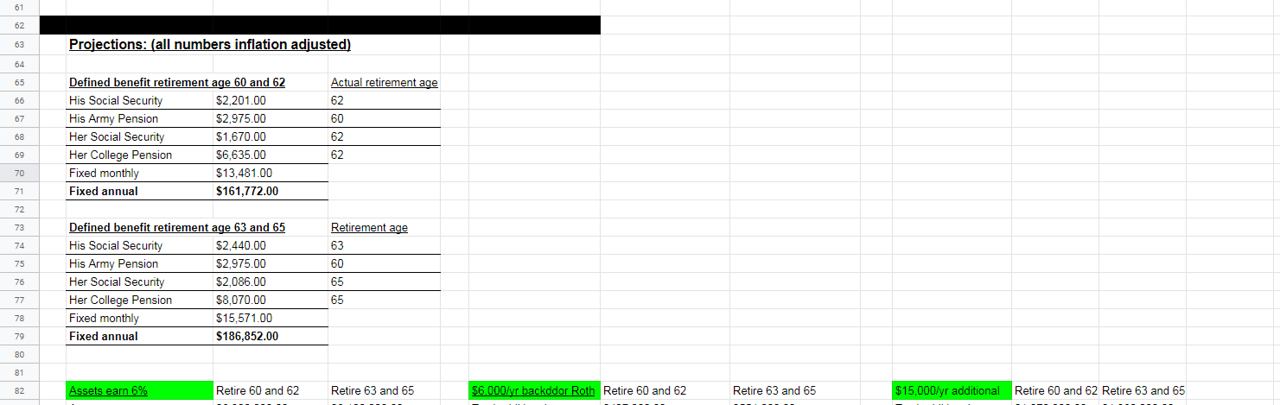

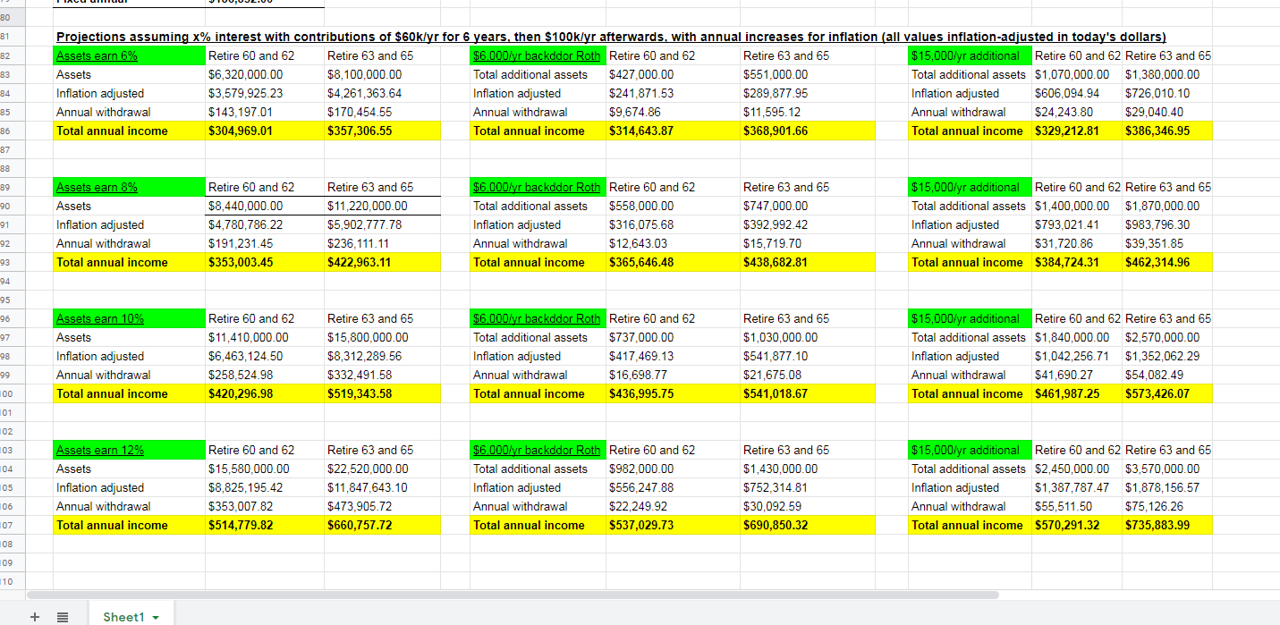

- A sheet (tab) for projected income and expenses, with a column for every year until you're 90 (or 100, or whatever you're comfortable assuming in terms of longevity). This is because you need to know where the funds are going to come from to live off of - whether it's passive income streams or portfolio withdrawals. My income and expenses tab has things like:

- Salary, Bonus, RSU vesting (3 separate rows for each of us), interest, dividends, tax exempt dividends, taxable IRA/401K withdrawals, social security (one row for each), RMDs (ditto), ST & LT Cap Gain distributions, ST & LT gains from taxable investment sales, etc.

- Expenses across major categories - "core" (housing, food, insurance, etc), HealthCare (premiums, deductibles & OOP - a row for each), taxes, vacation and "lumpy spending" - things like a new roof or other unexpected, major purchases.

- Net income (obviously, income less expenses)

- A sheet (tab) for money flow across all assets & liabilities - also by year, across your expected remaining lifetime. Mine includes very conservative return estimates, broken out by category - tax-deferred me, tax-deferred DW, taxable, cash, portfolio impact of RMDs, company stock sales, etc.

- The two tabs feed each other..for example, if I need X to cover expenses beyond expected income flow in a given year, that has to come from somewhere on the assets tab..similarly, if I have something left over (like this year, as DW is still working), it needs to go somewhere - into one or more of the accounts on the assets tab.

As others have suggested, the KEY thing is to have a very good handle on your expected expenses. We do, as I've tracked in Quicken (and other tools before that) forever. There will always be unexpected things - hence my "lumpy spend" row on the income/expense sheet. But, if you can get reasonable projections of core, healthcare, taxes and travel, you'll know what you need to cover. And then, either the income covers it - or you determine and map (column by column across years) what you're going to pull from on the assets & liabilities tab.

My sheet has a ton of other things including interest and dividend projections, stock sales, taxes, etc - and I wrote a pile of VBA code to automate much of it (eg: federal tax calculation based off income, LT Cap Gains/Qual Dividends) and more..

Hope that helps..as long as you get the key things of income/expense and assets BY YEAR (and don't forget to include inflation assumptions that increase your expenses each year), I'd say you're well on your way..