BoodaGazelle

Recycles dryer sheets

- Joined

- Mar 1, 2017

- Messages

- 284

I just read this in an article, referring to the current budget deal in Congress:

—————————————————————————————————————

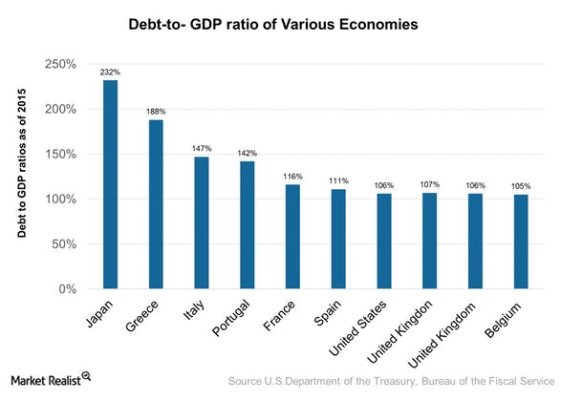

The federal deficit is set to exceed $1 trillion every year starting in 2022. According to the Congressional Budget Office, spending as a percentage of gross domestic product (GDP) rises to 21 percent this year, on track to 28 percent by 2049. Only three years (the war-time years of 1944 and 1945, as well as 2000) have had higher spending-to-GDP ratios. The federal debt held by the public will increase to 92 percent of the economy in 2029, up from 78 percent this year. Interest on the debt as a share of the economy will soon surpass defense spending.

This is an unsustainable fiscal path.

—————————————————————————————————————-

I always come back to the quote from the economist Herbert Stein: “If something cannot go on forever it will stop”.

If I were 80 or more, I probably would not worry too much, but since this forum is the “E” (early) crowd, many people are probably my age (63) or even younger.

I know the arguments about “the rules for government borrowing are different than for individuals”, etc., but what do people think about this?

More importantly, have you. or do you plan to soon, make changes to protect your assets from some type of financial collapse?

—————————————————————————————————————

The federal deficit is set to exceed $1 trillion every year starting in 2022. According to the Congressional Budget Office, spending as a percentage of gross domestic product (GDP) rises to 21 percent this year, on track to 28 percent by 2049. Only three years (the war-time years of 1944 and 1945, as well as 2000) have had higher spending-to-GDP ratios. The federal debt held by the public will increase to 92 percent of the economy in 2029, up from 78 percent this year. Interest on the debt as a share of the economy will soon surpass defense spending.

This is an unsustainable fiscal path.

—————————————————————————————————————-

I always come back to the quote from the economist Herbert Stein: “If something cannot go on forever it will stop”.

If I were 80 or more, I probably would not worry too much, but since this forum is the “E” (early) crowd, many people are probably my age (63) or even younger.

I know the arguments about “the rules for government borrowing are different than for individuals”, etc., but what do people think about this?

More importantly, have you. or do you plan to soon, make changes to protect your assets from some type of financial collapse?