You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Vanguard Dividend Growth Re-Opened

- Thread starter teej1985

- Start date

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

What's the ticker?

Ed B

Recycles dryer sheets

Vdigx

what's the ticker?

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Yes, I know how to find a ticker.

My point was that with so many funds, and the various classes of the same fund, why doesn't the OP just provide the specific, unique ticker, and it wasn't clear if that was the exact formal name of the fund, it could have been descriptive? Why ask others to do this, and maybe come up with a couple tickers, and then have to ask which one?

Maybe this should be in the 'pet peeve' thread? If you ask something, provide the info, don't expect others to search for you?

-ERD50

Yes, I know how to find a ticker.

My point was that with so many funds, and the various classes of the same fund, why doesn't the OP just provide the specific, unique ticker, and it wasn't clear if that was the exact formal name of the fund, it could have been descriptive? Why ask others to do this, and maybe come up with a couple tickers, and then have to ask which one?

Maybe this should be in the 'pet peeve' thread? If you ask something, provide the info, don't expect others to search for you?

-ERD50

OMG, in other threads, people complain when people use tickers rather than fund names. There are no additional share classes of this fund, so it should have been obvious.

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

VDIGXThe fund re-opened at the beginning of the month after being closed for three years. Did anyone else establish a position?

Say the name, Vanguard Dividend Growth.

I have not opened a position, but may.

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

OMG, in other threads, people complain when people use tickers rather than fund names. ...

Simple solution, just do both if it isn't a very common one, like SPY, BND, etc (and by 'etc', I don't mean Ethereum Classic USD (ETC-USD)

And I also assume OMG is not OmiseGo USD (OMG-USD)

... There are no additional share classes of this fund, so it should have been obvious.

It would only be obvious after a search!

OK, I'll call it a pet peeve, but c'mon, you are looking for info, so why not make it easy for people, you'll likely get more/better responses that way. I'm just trying to be helpful.

And no, no position and likely never will. I'm not a fan of sectors, I want as much diversification as I can reasonably get.

-ERD50

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I don't see why you even needed a ticker to begin with.

Vanguard Dividend Growth.... it's that simple.

Vanguard Dividend Growth.... it's that simple.

Simple solution, just do both if it isn't a very common one, like SPY, BND, etc (and by 'etc', I don't mean Ethereum Classic USD (ETC-USD)). And this one being closed, probably isn't common to most of us.

And I also assume OMG is not OmiseGo USD (OMG-USD).

It would only be obvious after a search!

OK, I'll call it a pet peeve, but c'mon, you are looking for info, so why not make it easy for people, you'll likely get more/better responses that way. I'm just trying to be helpful.

And no, no position and likely never will. I'm not a fan of sectors, I want as much diversification as I can reasonably get.

-ERD50

I was not looking for information. I was sharing information. A popular fund that was closed for three years has re-opened, and nobody else mentioned it.

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

It is much appreciated.I was not looking for information. I was sharing information. A popular fund that was closed for three years has re-opened, and nobody else mentioned it.

dirtbiker

Full time employment: Posting here.

- Joined

- Apr 11, 2019

- Messages

- 630

Am I blind? I can't find the dividend yield on this fund. You'd think it would be prominently displayed in a high dividend fund.

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I use Marketwatch and other sites.Am I blind? I can't find the dividend yield on this fund. You'd think it would be prominently displayed in a high dividend fund.

https://www.marketwatch.com/investing/fund/vdigx

Not really a high dividend at this time.

I'm using SCHD, which is closer to 3%. Kinda middle of the road, I think. Has more companies (100).

When the crash comes we can brag about high yield we hold, right?

gwraigty

Thinks s/he gets paid by the post

I use Marketwatch and other sites.

https://www.marketwatch.com/investing/fund/vdigx

Not really a high dividend at this time.

I'm using SCHD, which is closer to 3%. Kinda middle of the road, I think. Has more companies (100).

When the crash comes we can brag about high yield we hold, right?

I'm using SPYD. 4.63%.

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I was not looking for information. I was sharing information. A popular fund that was closed for three years has re-opened, and nobody else mentioned it.

OK, thanks. But when I read "Did anyone else establish a position? ", I took it that you were looking for feedback/analysis of this fund, so that's just why I mentioned it would be helpful to you to provide a ticker, link, something other than what appears to be a generic name (even though it turned out to be a specific name, but how would I know that?). Sorry it turned into as big a deal as it did, I just really thought you'd get more feedback with a bit more info/background.

I use Marketwatch and other sites.

https://www.marketwatch.com/investing/fund/vdigx

Not really a high dividend at this time.

I'm using SCHD, which is closer to 3%. Kinda middle of the road, I think. Has more companies (100).

...

It does seem odd that a fund by this name would have a lower div than SPY or other S&P 500 fund (1.77% versus SPY at 1.82% ?).

....

I'm using SCHD, which is closer to 3%. Kinda middle of the road, I think. Has more companies (100).

When the crash comes we can brag about high yield we hold, right?

We will see. SCHD doesn't have much history, but some of these other div funds really didn't do much different than SPY or VTI (Total market).

VDIGX did seem to hold up slightly better if you measure from the peaks, but since inception it has mostly lagged a bit:

https://stockcharts.com/freecharts/perf.php?SPY,VDIGX (set the slider to "ALL").

-ERD50

Last edited:

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Am I blind? I can't find the dividend yield on this fund. You'd think it would be prominently displayed in a high dividend fund.

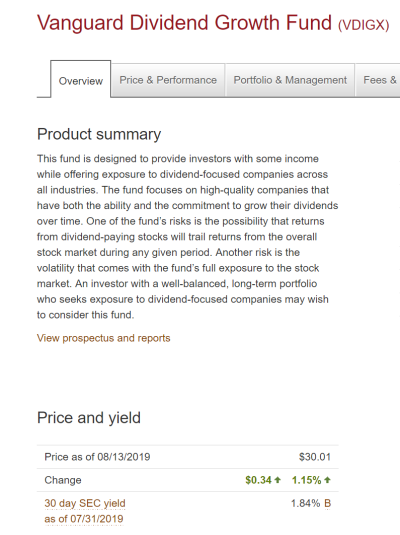

They give an SEC yield of 1.84% as of 7/31/19 on the first page of the fund. That spec would be comparable to the S&P500 yield.

And under distributions, you can calculate the trailing yield of the fund yourself:

https://investor.vanguard.com/mutual-funds/profile/distributions/vdigx

dirtbiker

Full time employment: Posting here.

- Joined

- Apr 11, 2019

- Messages

- 630

I use Marketwatch and other sites.

https://www.marketwatch.com/investing/fund/vdigx

Not really a high dividend at this time.

I'm using SCHD, which is closer to 3%. Kinda middle of the road, I think. Has more companies (100).

When the crash comes we can brag about high yield we hold, right?

They give an SEC yield of 1.84% as of 7/31/19 on the first page of the fund. That spec would be comparable to the S&P500 yield.

And under distributions, you can calculate the trailing yield of the fund yourself:

https://investor.vanguard.com/mutual-funds/profile/distributions/vdigx

Thanks. This is an oddly low yield, given the name of the fund.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Thanks. This is an oddly low yield, given the name of the fund.Though, to be fair, it is a dividend growth fund, not dividend yield fund, so time will tell if it's an appropriate name.

This is not, in fact, a high dividend yield fund. This is a dividend growth fund - big difference. It targets companies expected to grow their dividends faster than average.

Vanguard has a high dividend yield fund - different fund. VHYAX with SEC yield on 7/31/19 of 3.37%.

Last edited:

foxfirev5

Thinks s/he gets paid by the post

- Joined

- Mar 22, 2009

- Messages

- 2,987

If your living off dividends I've read that it would take about 15 years for dividend growth funds accumulated dividends to catch a high dividend fund. I believe the comparison was between iShares HDV / High Dividend and DGRO / Dividend Growth. However, historically dividend growth has a significantly high total return, not much different than total stock market in the long run. I own them all with total stock market still my largest holding.

You can't use the From Inception data for the Vanguard Dividend Growth fund for anything meaningful. It used to be the Vanguard Utilities Income Fund...the Fund strategy changed at some point in the 2000's. Current manager since 2006 I believe. This is not a high dividend fund.

The fund re-opened at the beginning of the month after being closed for three years. Did anyone else establish a position?

I've owned it in DW's IRA since 2011. It's a good fund. It's up about 135% (I added to the position about 3 years ago). It's Dividend Growth, not a high dividend, to echo the above, which is a popular strategy (rate of growth in dividend is comparatively high).

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Attachments

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

This is not, in fact, a high dividend yield fund. This is a dividend growth fund - big difference. It targets companies expected to grow their dividends faster than average.

Vanguard has a high dividend yield fund - different fund. VHYAX with SEC yield on 7/31/19 of 3.37%.

But the fund has been around a long time, so shouldn't we expect the divs to have grown by now?

Or are they really looking for the stocks at the beginning of a (hopefully) dividend growing trajectory, and buy them when divs are still low, and dump them once they actually have grown their dividends? Maybe then they move them to their VHYAX fund?

-ERD50

Similar threads

- Replies

- 9

- Views

- 430