I notified H&R Block about an error and was hoping it would be fixed in their Update released today. It is not fixed. All they said was we'll report it up two levels and take a look. I wonder if Turbo Tax has the same issue. Or perhaps my understanding of the 2020 MFJ maximum contribution is not correct.

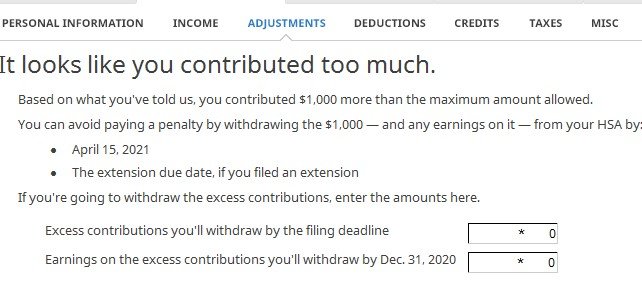

Here's the issue: I believe that the 2020 MFJ HSA maximum for two persons that are both 55+ and under a HSA Qualified single Family insurance Plan and each has their own HSA account is $9,100 and simply derived from $7,100max + $1000 catchup + $1,000 catchup. However, the software currently derives the maximum as $8,100 without penalty. I'm guessing it does not recognize that each person has their own HSA account.

Is my thinking correct? Does TT compute it correctly?

Here's the issue: I believe that the 2020 MFJ HSA maximum for two persons that are both 55+ and under a HSA Qualified single Family insurance Plan and each has their own HSA account is $9,100 and simply derived from $7,100max + $1000 catchup + $1,000 catchup. However, the software currently derives the maximum as $8,100 without penalty. I'm guessing it does not recognize that each person has their own HSA account.

Is my thinking correct? Does TT compute it correctly?

I'll probably have to delete the Return and start a new file from scratch.

I'll probably have to delete the Return and start a new file from scratch.