That book is a good read. It provides some insight into some the questions we all have asked many times... and a few things I had not thought about.

Yes. And this thread discussion has also led me to ask more questions. Please see below.

... the chapter you cite tells that the failures he finds with PE below 12.5 are at 6% WR, 40% equities. As PE he is using what he calls PE4.

Thanks for pointing this out. At my previous post, I did not go back far enough from the referenced chart to see that the above was the premise for all the subsequent discussions. My fault.

He also states that at a WR of 4%, you should have a lifelong portfolio.

I see that too, but now I have other questions after thinking more about this P/E business. More on this below.

By the way, I still would like to see what I asked for- examples of portfolio failures at 4% WR and PE 10s <=10, and normal allocations.

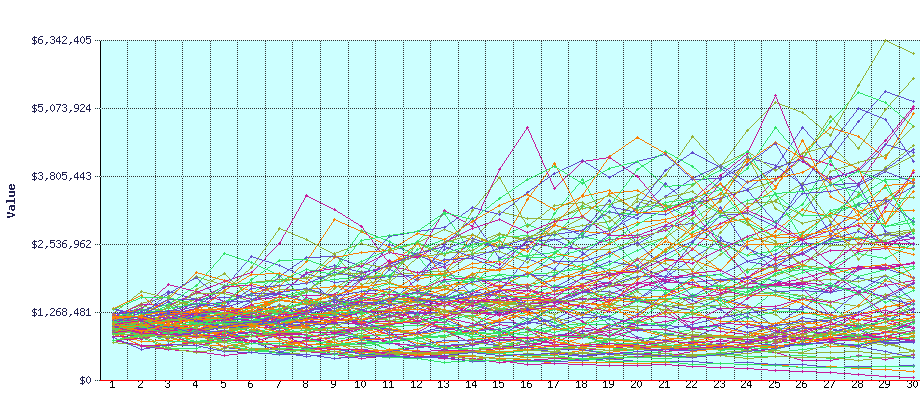

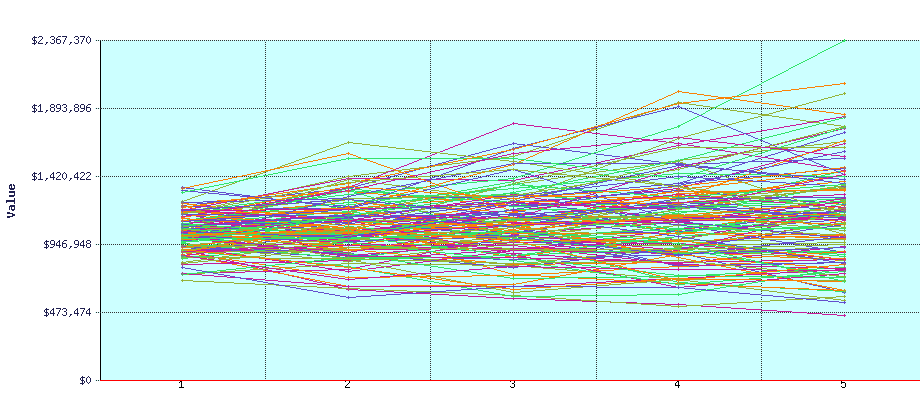

Using past histories, FIRECalc says that one would fare better with a higher stock allocation, so I use 70% equities, 4% SWR, and with everything else in default. It told me that the chance of success would be 83%. So, I have no doubt that if one imposes the PE condition like you stated, there would be no risk of failure.

But, but, but the problem we have is with the PE being as high as it has been, should we reduce the SWR to reflect the higher risk of lower total returns of the years ahead?

Let me state here again that, as I still have part-time income and not yet in the distribution phase, I have not studied this subject as thoroughly as many people here. Most of my experimentation with FIRECalc was made in the last few days. And I just read Otar's book a couple of days ago. This means that other people have given this much more consideration, and I will have much to learn from this discussion.

All this talk about P/E got me more curious, and I have more questions. Looking at the past histories of PE

here going back to 1881, one can see clearly the effect of "P/E expansion" since 1990. This has been discussed much by experts in the past. Something has changed fundamentally. Is it better or worse, I don't know, but the stock market is definitely different than it was before 1980 or 1990. The phenomenon of P/E expansion was what gave me the stash that I have now. I once thought its growth was due to my brilliance, but it now makes me leery.

And speaking of the dividend yield, this

chart also shows the dividend yield going back to 1881. It looks like it was averaging around 5% up to 1955, and perhaps 3.5% from 1955 to 1990. Compared to those, the S&P 500 dividend yield since 1990 looks pitiful, and is only 1.8% now.

With a high dividend yield in the past, it is no wonder then that a WR of 4% would be no sweat in the past. And for a retiree in the 1990-2010 period, the P/E expansion gave plenty of cap gains to enjoy.

By the way, I also found this chart of

historical inflation interesting. A hundred years ago, there were periods of high inflation alternating with high deflation. The wild gyration in the past (1882-1950) makes our recent experience a mere molehill. Should we thank the Fed for that?

Looking ahead, what can we expect? Dividend yields to return or should we continue to look for and depend on cap gain? I recall that we have had a recent thread about 2.1% real return in the years ahead, and rereading it, I now remember that I decided then that a small motor home in the mountains of New Mexico would be my back up solution.

We seem to be solidly in the green zone.

The truth is that if I am to retire right now, we can maintain the existing lifestyle on 3%. Once we get SS at 62, we can live well on even less. In addition, I do not worry about living for more than 30 years. So, I'm set, I think.

Even though my conservative nature will not let me push the WR to the highest possible whatever that might be, the discussion of SWR leads to me learning more, and is intellectually interesting.