Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

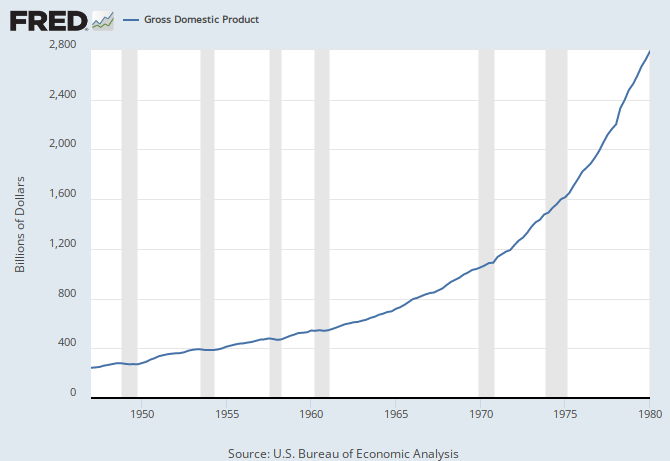

I'm going to need some help with this one. Real GDP went up?

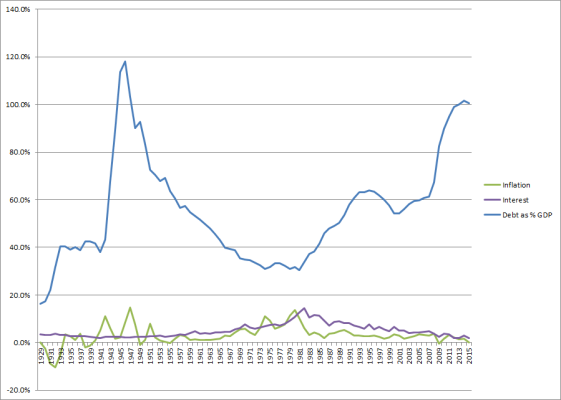

Yes, but when talking about things like debt / gdp as we are in this tread all the values are nominal.

So here's what nominal GDP did from 1940-1980 according to the Saint Louis Fed. That's the period when debt to GDP declined.

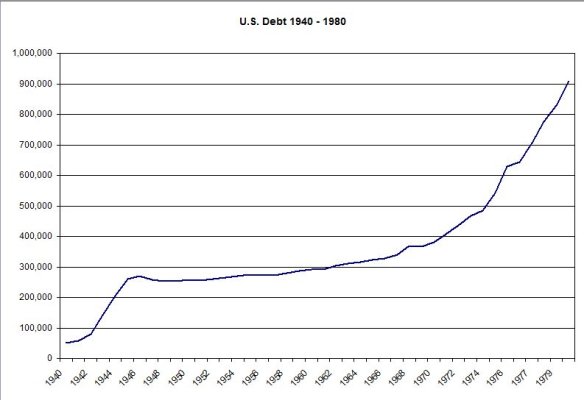

And the attached file shows what U.S. debt outstanding looks like over the same period according to the White House historic tables ( https://www.whitehouse.gov/omb/budget/Historicals )

Both went up. GDP went up more so the debt / GDP ratio declined.