pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Wouldn't it make the most sense for the person most likely to live the longest to delay, which I think would normally be the female spouse if both are healthy or the healthiest of the two otherwise?

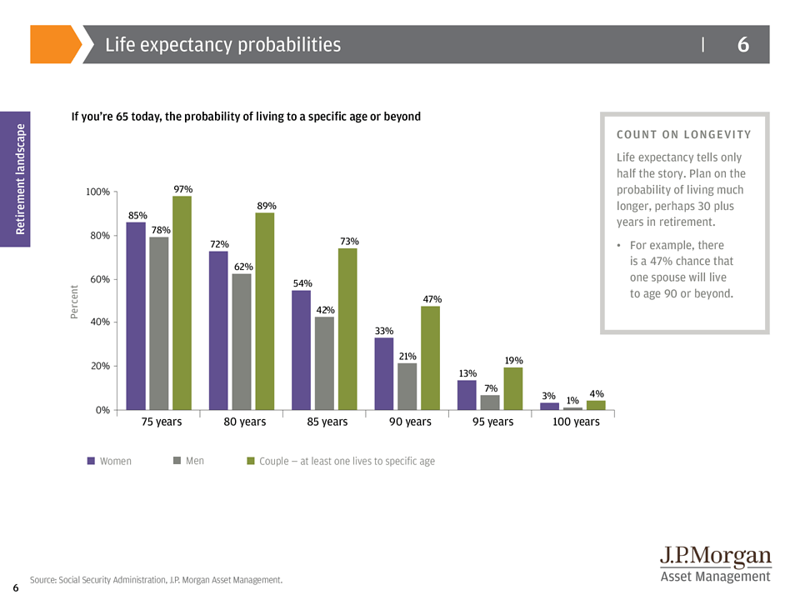

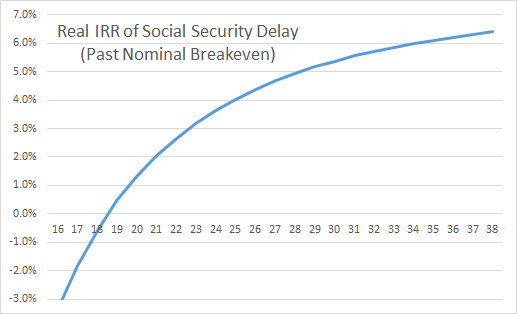

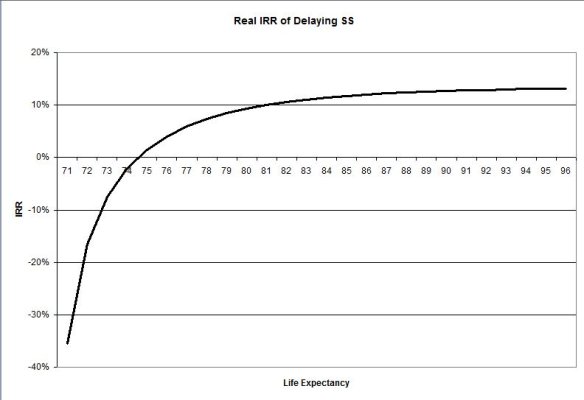

No because the lower earning spouse received the SS that was received by the higher earning spouse if the higher earning spouse dies. So if as the higher earnings spouse I wait until 70 then we collect my benefit until both of us die.... based on joint mortality there is a 50% chance that one or the other of us will live to be 94 so that is well past the breakeven point which is usually in the low to mid 80s.