Ha, I have miles to go before I sleep. I reckon I'll have ample opportunity to rerun FireCalc, war game final budgets, etc, etc, etc. before pulling the trigger, or having it pulled for me. But I take good cheer whenever I find good news.

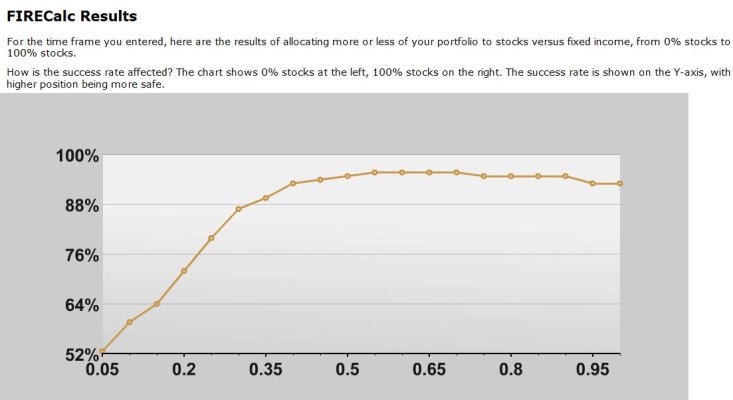

Wouldn't say I trust the author too much. He seems to be in the 100% success rate camp, which I think is silly. But I've seen articles suggesting 6.5% WR is rational in American historical stock markets, so this 4.75% feels right. I'll do due diligence eventually. Most posters on this site are much more conservative than I'd ever want to be.

I just have DW and she's feisty enough. I reckon she'll get by okay, regardless.

I was too close to giving up or starting over just three years ago. The finish line isn't in sight, but I can imagine it. Optimistic news like this really gives me a boost.

Oh I just noticed your from Woodstock.

Oh I just noticed your from Woodstock.