You really should include "tax expenditures" in this. Only one has been mentioned, the deduction for employer provided health care insurance. There are many more, and they are much bigger than the subsidies. From the CBO (chapter 3,

here), just in 2017 they amounted to $1.7T.

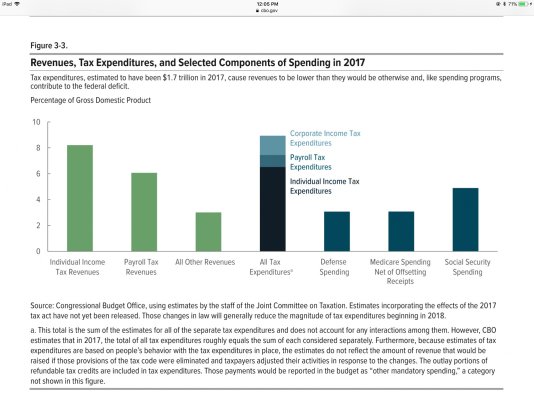

Tax expenditures have a major impact on the federal budget. CBO estimates that in fiscal year 2017, before the 2017 tax act and subsequent legislation took effect, the more than 200 tax expenditures in the individual and corporate income tax systems totaled almost $1.7 trillion—or 8.9 percent of GDP—if their effects on payroll taxes as well as on income taxes are included. That amount equaled more than half of all federal revenues received in 2017 and exceeded spending on Social Security, defense, or Medicare

From the CBO report, the largest 10 items follow. Note, the first two,. together, represent 2.7% of GDP, or

$500B this year.

•The exclusion of employers’ health insurance contributions is the single largest tax expenditure in the tax code; including effects on payroll taxes, that exclusion is estimated to have equaled 1.5 percent of GDP in 2017.

• The exclusion of pension plan contributions and earnings has the next largest impact, resulting in tax expenditures that are estimated to have totaled 1.2 percent of GDP last year, including effects on payroll taxes.

• Tax expenditures for the deferral of corporate profits earned abroad are estimated to have equaled 0.6 percent of GDP in 2017.

• Tax expenditures for deductions for state and local taxes (on nonbusiness income, sales, real estate, and personal property) are estimated to have equaled 0.5 percent of GDP in 2017.

• Tax expenditures for interest paid on mortgages for owner-occupied residences are estimated to have been 0.3 percent of GDP last year.

• Tax expenditures for charitable contributions are also estimated to have equaled 0.3 percent of GDP in 2017.

• Tax expenditures for the preferential tax rates on dividends and long-term capital gains are estimated to have totaled 0.7 percent of GDP in 2017.12

• The Affordable Care Act provides a refundable tax credit, called the premium tax credit, to help low-and moderate-income people purchase health insurance through exchanges. Tax expenditures for those credits are estimated to have totaled 0.3 percent of GDP in 2017.

• The tax expenditure for the earned income tax credit is estimated to have been 0.4 percent of GDP last year.

• The tax expenditure for the child tax credit was also estimated to have been 0.3 percent of GDP in 2017.