He did indeed completely change his tune after many of his clients reacted very poorly to the 2008/2009 market crash.

How so? I read the earlier quote posted and it appears to reinforce the "when you've won the game, quit playing" as Bernstein talks about people who had indeed won the game but kept their equity positions unnecessarily high, only to watch it vaporize in the 2008 downturn. They then compounded the problem by selling into weakness. Seems that's exactly the point - they had won the game, so should have reduced equity to a more manageable / lower risk level. (Bernstein also goes on to say that too many equities in retirement can be "nuclear level toxic", and I agree).

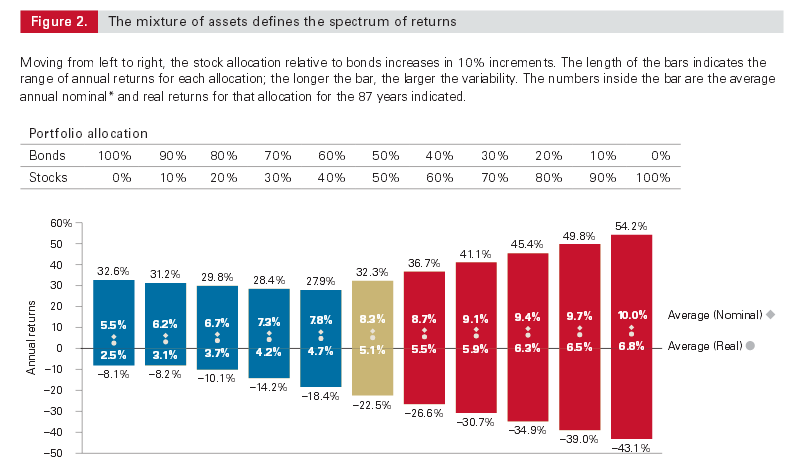

I wouldn't interpret "quit playing" as being TOTALLY out of stocks. But instead to dial back your equity exposure to a much more reasonable level (say, 50% or less). If you follow the very common "age in bonds" mantra, a 50+ YO retiree should be 50+% in some kind of fixed income, which would include Bonds, Bond Funds, CDs, MMs, etc. Some may choose to ignore the "age in bonds" guidance, but that's just taking on risk that is in most cases entirely not necessary given the relatively small variations in average annual portfolio return at different AA allocations. Sure, fixed income is "boring" compared to stocks, but the dividend income can be a big part of what covers your annual expenses, also, without "touching the principal"..

It all comes down to risk, and an investor's ability to take on that risk. Bear markets do not always recover in 18 months, and there's no guarantee the next 10-20 years will be anything like the last 10-20 in terms of equity returns. There are multiple (too many for my comfort) periods throughout the market's history where it can take 5-10 years for the market to recover to it's previous levels. If you start with $1M in equities, and it takes 10+ years to get back to $1M in equities, a question we all have to answer is "am I comfortable selling part of my portfolio when it's worth (potentially much) less than I started with?" I'm personally not wild about finding myself in that scenario in retirement. So, I instead invest a good chunk of my portfolio in CDs, MMs, etc. If the market is down (like in 2018), those more liquid parts of the portfolio allow you to cover spending without having to drawn down the equity part of the portfolio. If, on the other hand, you're many years from retirement, you're still generating income via your human capital and a 5-10 year recovery time is not as big of a deal. In fact, you're buying at lower cost and can also take on much more equity risk with higher % equities overall. But with OP potentially no longer working, the human capital return goes way down (potentially to 0) and the risk being taken with the only other source of income (portfolio) becomes exponentially more important.

A good rule of thumb that I've heard many times is "don't invest a penny in stocks that you expect to need in <10 years". Good advice, IMHO and that's my own plan. The stock portion of my portfolio is my 10+ year money..I only hope DW and I are fortunate enough to live long enough to pull from it. Watching many friends and family in their 50s and 60s not make it to their next birthday, I'm increasingly aware that there might be a scenario where someone else is pulling from that 10+ year bucket.

So, to OPs original question on AA - having multiple "buckets" (as recommended by Christine Benz @ Morningstar) to cover different spending periods in retirement is a pretty good strategy. Unfortunately, 90% equities ties up most of the portfolio in a "10-year" bucket and OP may find himself in a tough situation (selling into a market where the value of his equity portfolio is less than he started with) unless there are other spending buckets established to cover those potentially 5-10 year periods where the equity position of the portfolio is down from where it started..

All JMHO but if OP is indeed retiring, 90% equities seems to be at best a very high risk strategy and building up some other "buckets" (1-3 years, 3-5 years at a minimum) with fixed income assets would be recommended, especially at his age and job status..