KM, Is it not true that a 90 year old can enroll in a Medicare Advantage zero premium policy? Not a trick question. Just asking. I think they can, and do. But I could be wrong.

You can switch to Medicare Advantage during the yearly open enrollment. You just aren't guaranteed to be able to get a supplement if you switch back to original Medicare (there are some exceptions where you can, but you can't if you are just choosing to switch back).

All I can say is that it was far, far, far easier for my mom during her last few years of life (especially the last year) that she had original medicare and a supplement than if she had Medicare Advantage (whether zero premium or not). But, if she had been really tight on money she could have switch to any Medicare Advantage plan.

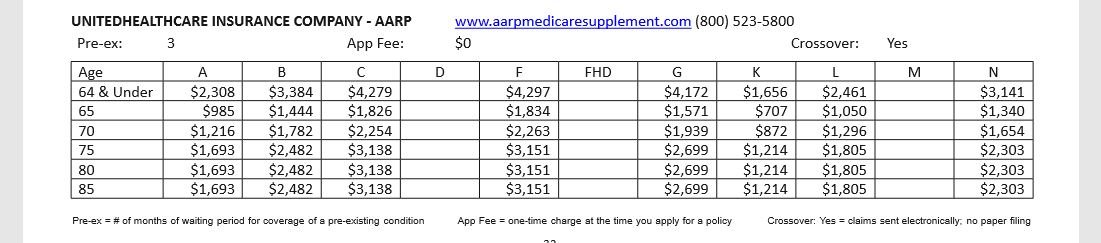

Just to give a comparision:

I have two mothers -- an adoptive mom and a birthmother. In early 2018 that were both gravely ill. My birthmom broke her hip and then went into a downward spiral.

After her hip surgery she went to a series of rehab facilities where she declined steadily. Ultimately she went home with home care and was in hospice and then a nursing home. The good news was that she rebounded and is fine now.

My adoptive mom had many chronic illnesses that suddenly worsened in early 2018. She spent 2 1/2 months either in the hospital or rehab before dying.

My birth mom has a Medicare Advantage plan (I don't know if it was zero premium or not). My sister mostly helped with getting her medical care. She spent endless hours on the phone trying to find the right help. A huge issue was that she a list of in network rehab facilities and couldn't do out of the network. And, she had to get approval for everything such as moving her from a facility they were unhappy with.

For my adoptive mom, she could go to any place that took Medicare. We had a huge choice of facilities. In fact, my sister told me that she had wanted to send my birthmom to the same rehab my adoptive mom was in. But, she couldn't. It was out of network for the Medicare Advantage plan.

Oh, the EOBs for my mom's last few months (2 1/2 months) showed the supplement company paid about $9700. Of course, you might say well she didn't spend that every year. And, it is true she wasn't hospitalized every year. But, she had chronic illnesses - heart failure, Type II diabetes and kidney failure - so she saw physicians quite regularly and had lots of tests, etc. She had huge prescription costs which were helped with her Part D plan.

Oh - I don't think she had been diagnosed with any of those illnesses when she turned 65. All of that basically came later.