target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

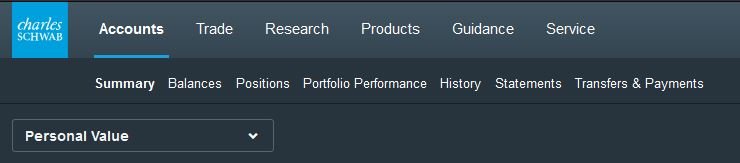

For us, Fidelity is 15 minutes away while Schwab is 30. I mentioned I'm investing at Schwab. About 10 years ago I set up a brokerage account at Schwab to receive gifted stock. The paperwork was all done in the office, and the individual was very professional.I may go with Fidelity since I have an existing brokerage account already (hasn't been used in over 10 yrs) and I have no experience with Schwab yet. The Fidelity account has very little money in it. My one hesitation is that Schwab has an office a 15min convenient drive away for me. Closest Fidelity office is almost an hour drive.

Probably not big deal but ...

Later I helped daughter set up an account, and we used the same office. Again, it was very quick, with encouraging words from other side of desk.

I don't really need an office, as I'm comfortable with the online interface. But the times I went their everything was cordial and efficient.

I think you'll have the same good experiences with Fidelity.

The best you can do, unless you're already a customer, is listen to other people that are customers of both.

The best you can do, unless you're already a customer, is listen to other people that are customers of both.