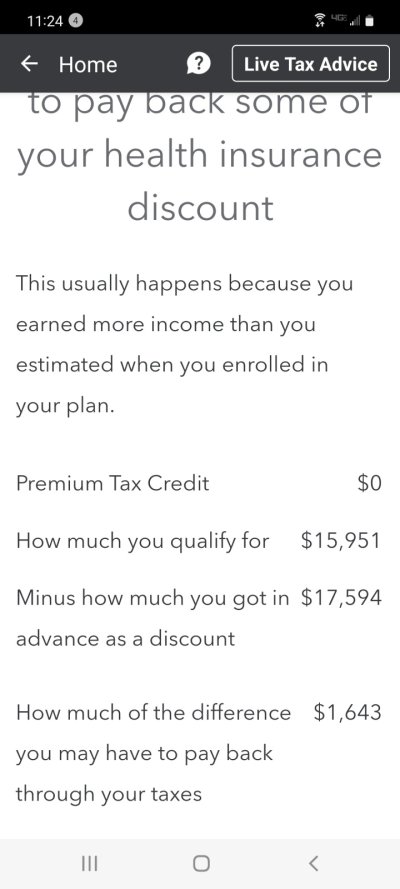

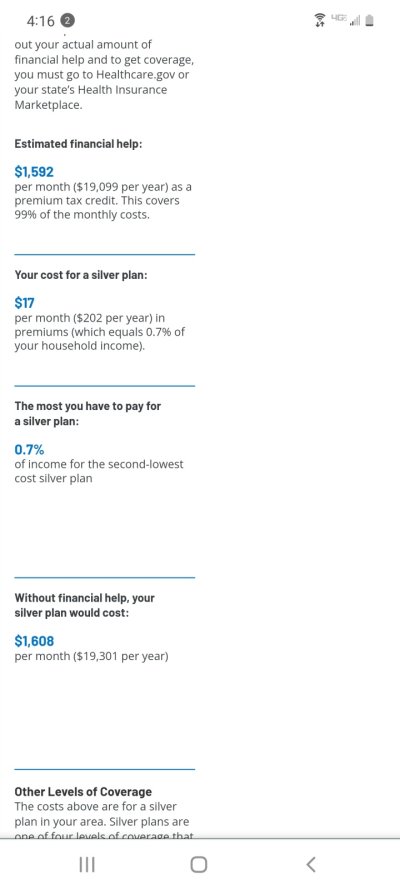

I live in Florida. My MAGI for my spouse and I is $28,822. TT is claiming I am only allowed $15,951 per year in subsidies but the Healthcare calculator computes I am allowed $19,956 per year.

Since my insurance premiums were $17, 592 per year, this means TT is computing I owe the IRS about $1600 which is an error.

How do I correct this mistake? Just ditch TT? Pat for TT and then print out returns, correct myself and then mail in taxes?

Thanks

Since my insurance premiums were $17, 592 per year, this means TT is computing I owe the IRS about $1600 which is an error.

How do I correct this mistake? Just ditch TT? Pat for TT and then print out returns, correct myself and then mail in taxes?

Thanks