Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Exactly. I never believed it was transitory.

And this belief was based on what exactly?

Curious....

Last edited:

Exactly. I never believed it was transitory.

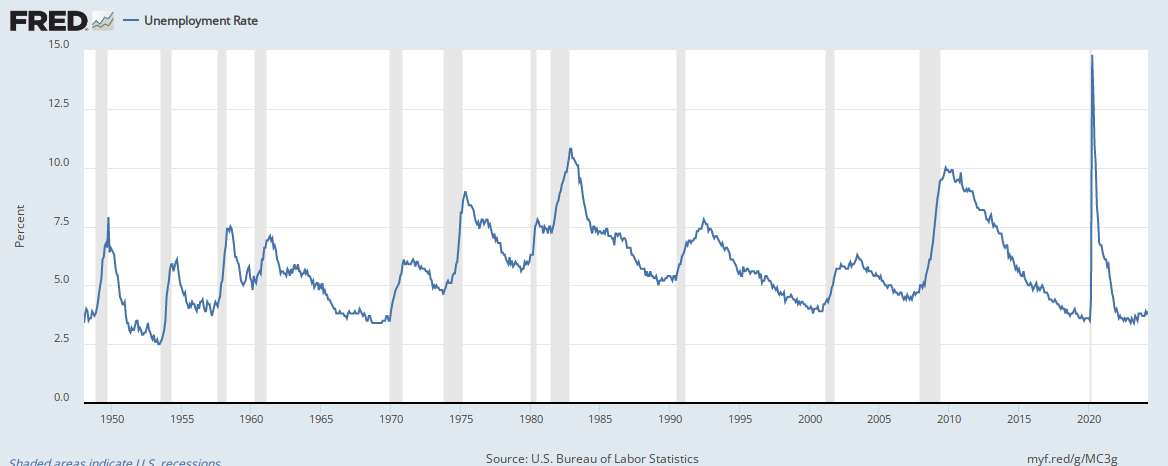

It is entirely possible the inflation we’re experiencing is transitory. That is to say, it is not chronic, where increases in prices and labor feed into each other and create a continuing loop with upward slope and is increasingly difficult to break. Transitory to a policy maker means something different than to us ordinary folk. The challenge is not ending inflation, it’s getting it down without causing a recession.

It’s also not clear the Fed has committed a major policy error. The counterfactual situation, where there was insufficient fiscal and monetary stimulus, might have been worse. That is, the consequences, in terms of unemployment, economic activity, asset prices, might have caused greater damage.

Over the next couple of years prices will adjust and most employed people will come out even. Middle class homeowners will see their homes appreciate in value while the fixed rate mortgage stays low. Holders of fixed rate fixed income, on the other hand, will feel permanent unrecoverable loss in purchasing power.

It is entirely possible the inflation we’re experiencing is transitory. That is to say, it is not chronic, where increases in prices and labor feed into each other and create a continuing loop with upward slope and is increasingly difficult to break. Transitory to a policy maker means something different than to us ordinary folk. The challenge is not ending inflation, it’s getting it down without causing a recession.

It’s also not clear the Fed has committed a major policy error. The counterfactual situation, where there was insufficient fiscal and monetary stimulus, might have been worse. That is, the consequences, in terms of unemployment, economic activity, asset prices, might have caused greater damage.

Over the next couple of years prices will adjust and most employed people will come out even. Middle class homeowners will see their homes appreciate in value while the fixed rate mortgage stays low. Holders of fixed rate fixed income, on the other hand, will feel permanent unrecoverable loss in purchasing power.

We are NO WHERE near having good CD deals, especially with any sort of longer-term duration.With inflation rising whose crystal ball can tell us when the CD rates will go up like 1984?I have some dry powder.

Cheers!

Not transitory. The currency collapsed and was replaced. Hyperinflation cannot be transitory.The hyper-inflation of the 20's Germany was transitory.

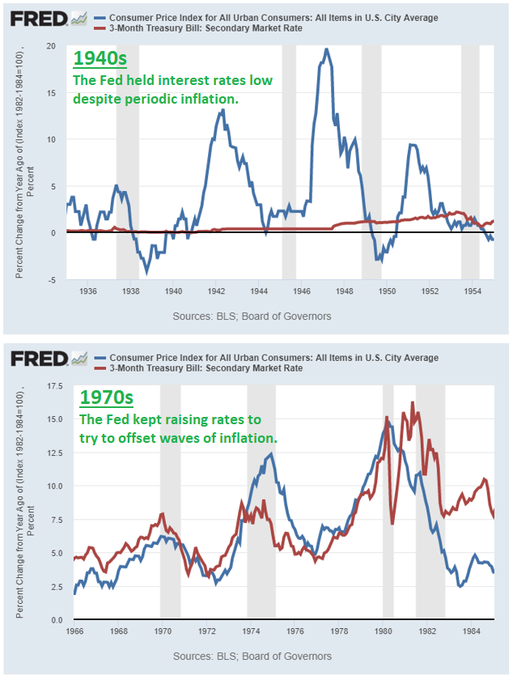

The same could be said about the early 1900’s and years leading up to the great depression. There’s no data to suggest either outcome is likely.On a less Godwin's law example, here is a chart of US Inflation of the late 60's/70's/early 80's:

If we are following a similar path, we have a lot of pain ahead.

The US$ no longer being the global reserve currency would be a net positive for the US. It’s not going to happen anytime soon, however, because there isn’t a viable alternative. This is definitely a role no other country wants.One thing that stood out to me of that time was the abandonment of the US $ convertibility to Gold (as outlined in the Bretton Woods framework). I believe we have a real risk now of a movement away from the $ as the reserve currency. IF that happens, watch out below. For example: India was an abstain on the recent UN vote against the Russian Ukraine invasion. What happens if India sets up a bilateral agreement with Russia regarding settlement of trade not using US $?

(Or should I say watch out above, because the effect would be a significant reduction in the buying power of the dollar.) Of course many other fiat currencies are also suspect, so who knows their relative strength.

If by situation you mean inflation in the US, it is not getting worse. There may be a short lived impact to trade because of the Russian invasion, but the greater effect to global trade can be contained, as Russia will continue to export.All I know is that the situation is getting worse, not better:

* The world is being split into us and them, and reduced trade (resulting in lowered standards of living overall)

* There is a lack of understanding of basic economics in terms of supply and demand. Already there are calls for price controls because of "unfair profits".

I would not be surprised to see price controls and perhaps even food rationing within a year.

We are NO WHERE near having good CD deals, especially with any sort of longer-term duration.

The last time we had a 7%+ inflation print, 10 year treasuries were yielding over 14%. Right now, we have negative (inflation-adjusted) real yields.

The US$ no longer being the global reserve currency would be a net positive for the US. It’s not going to happen anytime soon, however, because there isn’t a viable alternative. This is definitely a role no other country wants.

We are NO WHERE near having good CD deals, especially with any sort of longer-term duration.

The last time we had a 7%+ inflation print, 10 year treasuries were yielding over 14%. Right now, we have negative (inflation-adjusted) real yields.

This author seems to agree with you: An Exorbitant Burden

As for price controls and food rationing, that is quite unlikely, and I’ll take that wager and even give odds.

This author seems to agree with you: An Exorbitant Burden

Very good link, thanks. Michael Pettis is an expert on trade and capital flows, also China. It’s no exaggeration to say he is one of the most knowledgeable economists in the world on these topics, especially trade and China.

Ah, China. Well seeing how they seem to be shutting down many of the large manufacturing centers now because of a COVID outbreak, I don't see any of the supply/inflation issues going away anytime soon.

https://www.cnbc.com/2022/03/14/chi...en-orders-production-halts-control-covid.html

IMHO, there is a recession coming.

A lot of Monday morning quarterbacking in this thread.

The Big Boys really don't let us play in the big game, so what else can we do?

The Big Boys really don't let us play in the big game, so what else can we do? You state the obvious. That's our job and we're good at it here on FIRE Community!The Big Boys really don't let us play in the big game, so what else can we do?

By the way, as others have mentioned, many of us have been predicting this for a long time. Only thing I got wrong was I never guessed inflation would wait this long. Of course, I never went to Harvard or Yale so what can you expect when YMMV?

Ah, China. Well seeing how they seem to be shutting down many of the large manufacturing centers now because of a COVID outbreak, I don't see any of the supply/inflation issues going away anytime soon.

https://www.cnbc.com/2022/03/14/chi...en-orders-production-halts-control-covid.html

As long as China continues to adhere to a zero tolerance policy regarding Covid, the pandemic will never really end for them and the supply chain problems will never go away. They need to figure out a way to transition from zero tolerance to living with the virus like other countries such as OZ and NZ are doing.

Besides the zero tolerance issue, which hinders natural immunity from building up, the Chinese vaccine hasn't proved as effective against Omicron and its subvariant as the vaccines used in OZ and NZ, so as the song goes, they are kind of right back to where they started from.