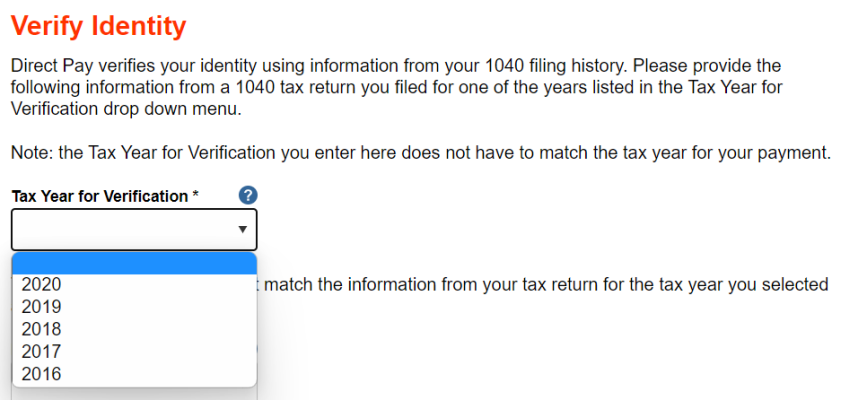

DD needs to make estimated payments this year. 2022 will be her second year filing taxes, with 2021 being the first. When she goes to make a Direct Pay transaction from the IRS Website , the second screen requires authentication based on, "verifies your identity using information from your 1040 filing history." That is, it needs information from earlier tax returns beginning in 2020 and going back. However, she did not file in those years. There is not an option to say did not file.

Anyone know how to get around this?

Anyone know how to get around this?