The best time to buy TIPS is when people are worried about recessions and deflation and not inflation, which might be coming up. After 2008, some of the yields hit 2 - 3%. TIPS at a 0% real return (which is what I bonds are currently selling for) over 30 years have a safe withdrawal rate of 3.33% (100 / 30 years = 3.33%). 1.3% real yield = 4% SWR, 3% = 5% SWR). This is for individual bonds, not funds or ETFs. Those do not mature like individual bonds. We have a ladder and usually buy at auction. They are best in retirement accounts as unlike I bonds, the inflation adjustments are taxable income. You can find the current yields here -

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us. All but the 5 years have real yields above 0% now, and those yields should go up more this year as the Fed continues to raise interest rates.

Social Security, pensions and a TIPS ladder cover all the money we need for our retirement expenses. At our ages stocks may or may not recover in our lifetimes.

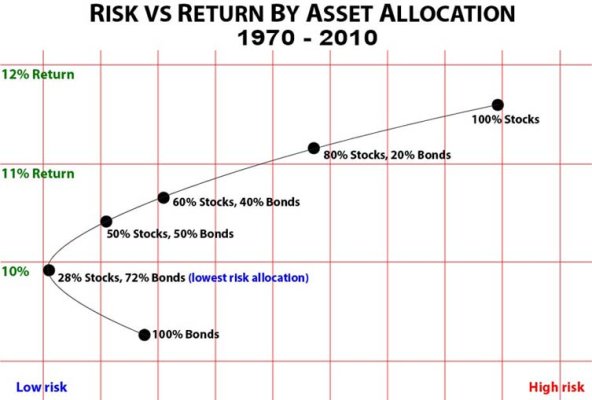

The Triumph of the Optimists book says stocks always do better than bonds in the long run, but based on a multi-country analysis that long run may be 40 years. I buy stocks with the money I can afford to gamble with and only as much as wouldn't hurt too much to lose half. The latest Morningstar projections are for a 50/50 stock and bond portfolio SWR to be 3.33 SWR, with a lot more volatility and no government backed guarantees. Wade Pfau's projections are even lower at 2.4% -

https://www.thinkadvisor.com/2020/04/14/wade-pfau-virus-crisis-has-slashed-4-rule-nearly-in-half/

Check out

The Bond Book for more info on TIPS. If mutual fund and insurance companies could make a profit off TIPS, they would be touting them as the greatest thing since cornflakes. But they can't, so they try to pretend like they don't exist. TIPS fit into an asset matching strategy for retirement funding -

https://www.bogleheads.org/wiki/Matching_strategy ( For the money you ‘must’ have, use matching strategies and for the money you would ‘like’ to have, use diversification and risky assets.) Bobcat2's posts on Bogleheads cover all of this.