You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Fidelity Retirement Analysis Tool

- Thread starter G-Man

- Start date

tmm99

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 15, 2008

- Messages

- 5,223

For those using the Fidelity Retirement tool, are you inputting the value of your home or the equity in your home in the tool? If so, what section of the tool are you inputting this data?

I don't add that info. It's not like I can sell the house and spend that money.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

No, only the assets I intend to use to fund retirement.

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

For those using the Fidelity Retirement tool, are you inputting the value of your home or the equity in your home in the tool? If so, what section of the tool are you inputting this data?

I do not and that doesn't really make sense to me, as it is not part of the investment portfolio, which will be drawn on. It is part of net worth, but retirement calculators don't use NW as the denominator.

One possible exception is if you are planning to sell your home and move into a rental. When we knew we were going into a CCRC, I showed the cash coming in and the entry cost coming out along with contract monthly payments. The tool does treat financial assets different than hard assets. To see, add a cash amount equal to your house value but don't list house as asset. Run the model and look at ending values. Then remove the cash and put the house in.

The Cosmic Avenger

Thinks s/he gets paid by the post

Reasonable, but I prefer an overly conservative estimate. I checked, and we have $ 54,000 /yr in long-term care costs built into the last 6 year(s) of our plan, because one of us has access to low cost LTCI. We would probably never need that, but I'd rather have it in there than not. As long as you have leeway for it costing more than that, IMO that's a fairly realistic estimate.Ok. One more question.

For long-term care cost, I am estimating 3 years at $100K per year (self-insured). Does that seem reasonable?

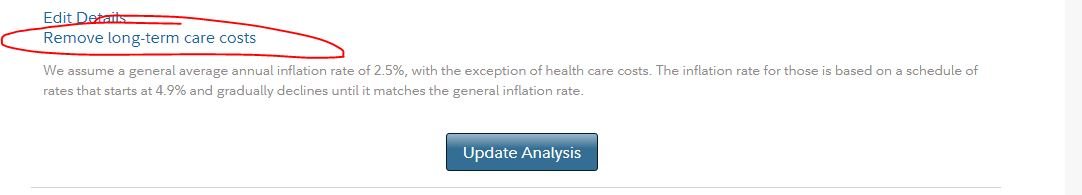

I am inputting my long-term care cost information using the link circled in red that is found in the tool.

EDIT: Oh, and we don't have our home equity in the planner, but I do use Fidelity's Full View for NW tracking, since we are considering moving or at least downsizing once we retire.

Last edited:

- Joined

- Nov 27, 2014

- Messages

- 9,251

Can folks please share their estimate for Long-term care cost. I'm going the route of self-insured LTC.

I’m trying to pass $1M to my heirs. If me or DW get caught with health issues, that will reduce or eliminate that ending balance. Some things you just can’t know, so while I’m trying to cover health costs by being conservative and thinking about my home value, if I fail, I guess I’ll just have a crappy end of life situation. Hopefully it will be of short duration.

TheWizard

Thinks s/he gets paid by the post

Can folks please share their estimate for Long-term care cost. I'm going the route of self-insured LTC.

I'm assuming that if I eventually need LTC that I would probably sell my house, right?

That by itself should cover several years of LTC expenses, not including my retirement income of well over $100k per year...

wmc1000

Thinks s/he gets paid by the post

We don't include our house in RIP but use the value in the full view, we have kept it the same amount since retirement in 2016 so we have a very big cushion in that regard as the current home is worth far more than our 2016 home.

As far as for long term care, we budget $60K for the last estimated 6 years of life to potentially cover 1 of us. If the second one needs LTC the house sale becomes the income generator to pay for it.

As far as for long term care, we budget $60K for the last estimated 6 years of life to potentially cover 1 of us. If the second one needs LTC the house sale becomes the income generator to pay for it.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I use $500,000 as my LTC reserve. It’s probably too much, but better than too little. I also don’t look at the house as a source of funds. You would need to sell it likely at a time that it would be an overwhelming task and what if only one of a couple needs care?

RetiredHappy

Thinks s/he gets paid by the post

- Joined

- Jun 27, 2021

- Messages

- 1,596

Not sure if you still want input. With LTCI, we have coverage of over $500K each. If self insured, I would go with $500K for one person. But as others have pointed out, you can always have reverse mortgage on your home if you choose to receive care at home. Otherwise, you can sell your home and move into a LTC facility.

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Can folks please share their estimate for Long-term care cost. I'm going the route of self-insured LTC.

My dad had one year of 24/7 home care in New Jersey which cost 135k net of reimbursements.

He had 2 LTC policies.

3 years of LTC is probably okay, but the 300k could be low.

RetiredHappy

Thinks s/he gets paid by the post

- Joined

- Jun 27, 2021

- Messages

- 1,596

G-Man, if you don't mind sharing, are you single, married and/or have children whom you would like to leave an inheritance? It makes a difference to the strategy on how to fund LTCI.

G-Man, if you don't mind sharing, are you single, married and/or have children whom you would like to leave an inheritance? It makes a difference to the strategy on how to fund LTCI.

Married no kids. The goal is to leave nothing.

RetiredHappy

Thinks s/he gets paid by the post

- Joined

- Jun 27, 2021

- Messages

- 1,596

I think there are LTCI plans that cover the couple as one plan. I am not familiar with them. I have traditional LTCI through Genworth (14 years and not have a rate increase yet - touch wood). My husband has a hybrid LTCI insurance through Lincoln called Moneyguard II. His is a one time lump sum and be done, so there is no worries about future rate increase. If it is not utilized, premium plus goes back to the beneficiary.

I think there are LTCI plans that cover the couple as one plan. I am not familiar with them. I have traditional LTCI through Genworth (14 years and not have a rate increase yet - touch wood). My husband has a hybrid LTCI insurance through Lincoln called Moneyguard II. His is a one time lump sum and be done, so there is no worries about future rate increase. If it is not utilized, premium plus goes back to the beneficiary.

I'm thinking about going the self-insured route.

Fidelity Retirement Planner

I retired in March 2018. I used the Fidelity tool, the tool in Quicken and Firecalc. I also would find users on this site and Bogleheads that had a history of retirement planning. I would read through their historical posts and compare their plans and retirement success with my plans. I was just under 60 when I retired with no debt, a company pension with a monthly payout similar to my expected social security, and retiree medical that cost about 300/month for a high deductible plan. Also had all my kids through college, no mortgage or car payments, and my wife still works mainly for medical. For me all the retirement tools lined up. I have been doing good in retirement. Like everything the result is only as good as the input on expenses and return. Though you selected significantly below market in the Fidelity tool, I would still compare with other tools. I ended up moving my pre-tax 401k to a Fidelity IRA, post tax 401k contributions to a Fidelity Roth IRA, HSA to Fidelity, and obtained the Fidelity credit card. Good luck.

I retired in March 2018. I used the Fidelity tool, the tool in Quicken and Firecalc. I also would find users on this site and Bogleheads that had a history of retirement planning. I would read through their historical posts and compare their plans and retirement success with my plans. I was just under 60 when I retired with no debt, a company pension with a monthly payout similar to my expected social security, and retiree medical that cost about 300/month for a high deductible plan. Also had all my kids through college, no mortgage or car payments, and my wife still works mainly for medical. For me all the retirement tools lined up. I have been doing good in retirement. Like everything the result is only as good as the input on expenses and return. Though you selected significantly below market in the Fidelity tool, I would still compare with other tools. I ended up moving my pre-tax 401k to a Fidelity IRA, post tax 401k contributions to a Fidelity Roth IRA, HSA to Fidelity, and obtained the Fidelity credit card. Good luck.

When looking at the planner, it shows the RMD amount. Yet that amount is NOT included in the total to withdraw for any particular year. Additionally, it is excluded from the TOTAL when you add SS pension and withdrawal amount. So the withdrawal + SS + pension equals the planned spend. The RMD looks like "extra".

Score is well over 100 when the planner is used in well below average mode.

So my question is: Does it assume you invest that amount and use it to make a future withdrawal?

Score is well over 100 when the planner is used in well below average mode.

So my question is: Does it assume you invest that amount and use it to make a future withdrawal?

Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I welcome any additional feedback.

Both states we have checked indicate current LTC expenses of about $10K/month. I'm sure some states are less so YMMV.

Similar threads

- Replies

- 1

- Views

- 691

- Replies

- 0

- Views

- 218

- Replies

- 50

- Views

- 7K

Latest posts

-

-

-

In Your City - What Are The Most Desirable Neighborhoods and Why?

- Latest: ShokWaveRider

-

-

-

-

-

-