Sounds like your IRA is very very large.

I am probably the minority here. But here is my home made strategy to avoid a tax torpedo from SS and RMD.

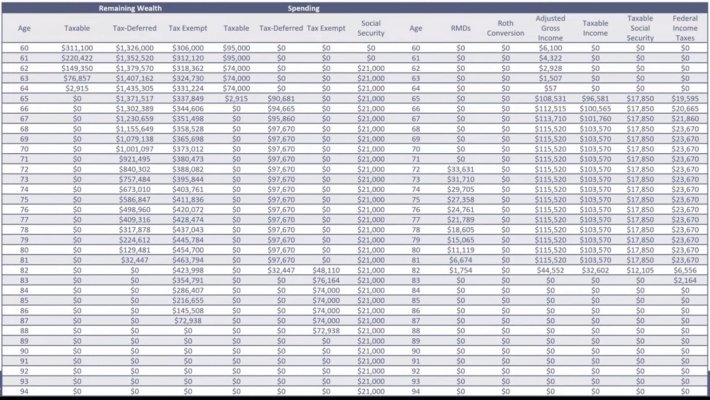

2 final Roth conversions 2022 & 2023. Leaving $450k in the regular IRA.

Both take SS at 62 in 2024 (SS =$35,800 yr /and around 27k from the IRA till around 82. (Will draw small amounts from the IRA over a long period of time. Rather than converting it all to Roth's.) Or a tax hit by pulling large chunks.

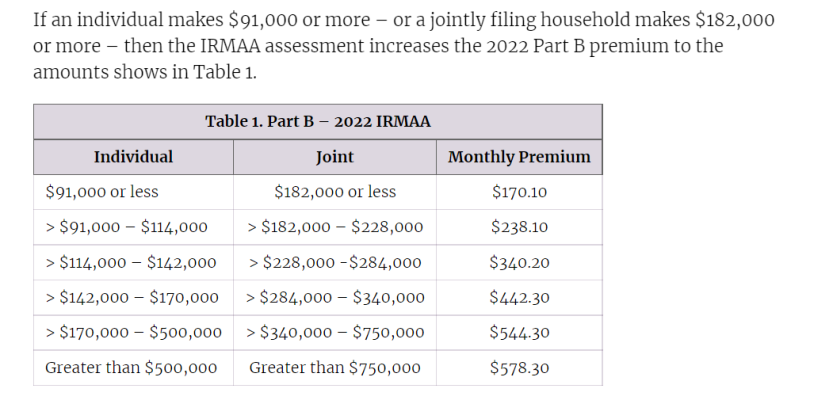

Combined with my other income's, I can control my income / tax bracket with IRA distributions. Intentionally staying in the 12/% bracket. 15% in 2026.

With no debt, I can easily live on $109,450.00

(12% $83550 + std ded. $25,900) And still save a bit every year if I wanted to.

Will adjust as the tax code changes. And yes, its going to change. And not in our favor. My prediction anyway.

Guess I am lucky, as my 401K / IRA was not all that large

. And will have several years of conversions in by 2023.