It was her decisions to work under the table and not save any of it for when couldn't work for income. Our decisions have consequences and these consequences need to be factored into our decision making process to make wise decisions, not snap judgements.DW had a friend like that. She hopped from job to job with many of her jobs doing house cleaning and other elder care taking and getting paid cash under the table. Also doesn't save. I've said for years that unless she has her 40 quarters in from her conventional job stints that she'll be in a world of hurt when she is in her 60s. The friend moved away about a decade ago and we lost touch so I'm not sure what is going on with her now.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Inflation and SS Triggers

- Thread starter Tekward

- Start date

Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

IMO, our congress-critters should fix the trigger levels.

I wonder how many of the never-beneficiaries are simply those that have chosen to live off the grid, out of the eye of Uncle Sam. They would be working for cash and never paying into SS.

As an aside, I knew a fellow who emigrated to the US, worked and paid into SS and had earned benefits. He lost his job when the plant closed. The good news was that he was old enough to collect SS. Unfortunately, he had falsified his age decades earlier when coming to the US. As a result, while he was chronologically old enough to collect SS, his records showed he was not. I often wonder if he ever resolved the age issue with the SSA and collected SS or had to find a way to bridge the gap. I imagine this would also have affected his Medicare eligibility.

A couple thoughts.....

People who took cash and did not pay into SS are common. I knew a guy, a very skilled handyman. I doubt if he declared half his income. I hope he invested a lot of the tax dollars he owed but never paid. My guess is he did not. He tended to spend very freely. Today he is likely clomplaining about his very low SS paycheck.

Also, during WW2 a lot of parents in occupied areas shaved a few years off their male child's age so they would not be taken and forced to work for the war effort. Their new age forced them to retire a few years later whether they wanted to or not. I have to think had they not lied about their age, they would have not lived long enough to retire.

It's difficult to understand how some people could make the choices they have in life. In some cases, they may just be mild forms of mental illness, yet serious enough to cause lifelong problems.It was her decisions to work under the table and not save any of it for when couldn't work for income. Our decisions have consequences and these consequences need to be factored into our decision making process to make wise decisions, not snap judgements.

SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Fortunately, the increasing amounts of Federal income tax on SS income feeds right back into the SS and Medicare trust funds, per this link:

https://www.ssa.gov/oact/progdata/taxbenefits.html

I wonder how that works exactly.

From looking at a tax return, taxable SS adds into AGI, which then feeds into the tax calculations. The amount of federal income tax paid on the taxable SS will depend on the amount and types of other income. I think it could be anywhere from zero to close to half (the "SS tax torpedo" people mention here occasionally).

The above link makes it sound like the IRS sends some amount of tax receipts to SS based on taxable SS included in AGI. But since it varies, I wonder how much is sent and how it is calculated.

The other possibility is that IRS receipts go into the Treasury, and whenever the SSA needs funds and cashes in their special Treasury notes, those would be paid out of the Treasury. Maybe that's what it means.

Anyone know? Just curious mostly.

athena53

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 11, 2014

- Messages

- 7,383

Some people get caught in the middle, which isn't good when you're getting no SS and have to pay $1000/mo in Medicare premiums (for one person) because you don't qualify for premium free Medicare Part A, so you have to pay $499/mo extra vs. what most people would pay.

Over my career, my employers and I paid $190,000 to Medicare. Accumulated at 6% it would be about $310,000.

$500/month is a bargain although I agree that for your friend it's a burden.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

It's difficult to understand how some people could make the choices they have in life. In some cases, they may just be mild forms of mental illness, yet serious enough to cause lifelong problems.

WADR, I don't buy the whole mental illness card thing... that might be true in some cases, but in the cases that I'm thinking about the people are just cheap and didn't want to pay tax on that income, social security or income taxes... so let's not give them a free pass that they don't deserve by calling it a mental illness.

Unless suddenly, cheap is a mental illness.

- Joined

- Apr 14, 2006

- Messages

- 23,113

WADR, I don't buy the whole mental illness card thing... that might be true in some cases, but in the cases that I'm thinking about the people are just cheap and didn't want to pay tax on that income, social security or income taxes... so let's not give them a free pass that they don't deserve by calling it a mental illness.

Unless suddenly, cheap is a mental illness.

You say cheap, I say criminal. Non-reporting of income is a crime, and I have very little sympathy when criminals bite themselves in the butt.

Last edited:

"In some cases" is exactly what I had stated, not the majority of cases. I'm thinking more of the people that aren't able to work, or that no one will hire, or they can hold down a job..... in some cases.WADR, I don't buy the whole mental illness card thing... that might be true in some cases, but in the cases that I'm thinking about the people are just cheap and didn't want to pay tax on that income, social security or income taxes... so let's not give them a free pass that they don't deserve by calling it a mental illness.

- Joined

- Apr 14, 2006

- Messages

- 23,113

We have a variety of social welfare programs for those people (SNAP, Medicaid, Section 8, etc), which I fully support. The Social Security system is not one of them."In some cases" is exactly what I had stated, not the majority of cases. I'm thinking more of the people that aren't able to work, or that no one will hire, or they can hold down a job..... in some cases.

Last edited:

Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

You say cheap, I say criminal. Non-reporting of income is a crime, and I have very little sympathy when criminals bite themselves in the butt.

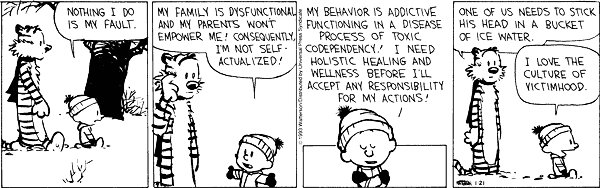

Come now, Mr. Gumby. This lad has an explanation you might consider:

What bothers me most is not how accurate the SS adjustment is but the fact that it does little to offset the decline in real value of my many years of savings and investment. Savings interest rates are still a weak shadow compared the the inflation rate. In my mind this is far worse than the 1980's when we saw double digit inflation, but also some double digit interest rates on savings.

Attachments

Last edited:

TheWizard

Thinks s/he gets paid by the post

I think it's fine if certain types of skilled tradesmen (women) do a certain percentage of work under the table to avoid paying excess income tax and OASDI.A couple thoughts.....

People who took cash and did not pay into SS are common. I knew a guy, a very skilled handyman. I doubt if he declared half his income. I hope he invested a lot of the tax dollars he owed but never paid. My guess is he did not. He tended to spend very freely. Today he is likely complaining about his very low SS paycheck...

But they need to sock a good part of that money away for their older years.

But apparently some don't?

So whose fault is that?

CardsFan

Thinks s/he gets paid by the post

I think it's fine if certain types of skilled tradesmen (women) do a certain percentage of work under the table to avoid paying excess income tax and OASDI.

But they need to sock a good part of that money away for their older years.

But apparently some don't?

So whose fault is that?

Curious. Just WHY is that FINE?

I know many UNION tradesmen that took side jobs. No union dues, no taxes. Put the card in the pocket and all is fine.Meanwhile, I paid taxes on every dime I earned.

And then they wonder about me trying to LEGALLY save money on taxes.

TheWizard

Thinks s/he gets paid by the post

Curious. Just WHY is that FINE?

I know many UNION tradesmen that took side jobs. No union dues, no taxes. Put the card in the pocket and all is fine.Meanwhile, I paid taxes on every dime I earned.

And then they wonder about me trying to LEGALLY save money on taxes.

Because I think it's totally unreasonable to expect to be able to eliminate the underground economy.

Just like it was totally unreasonable to expect prohibition to succeed 100 years ago.

If you don't agree with me, that's fine...

- Joined

- Apr 14, 2006

- Messages

- 23,113

Because I think it's totally unreasonable to expect to be able to eliminate the underground economy.

Just like it was totally unreasonable to expect prohibition to succeed 100 years ago.

If you don't agree with me, that's fine...

Failing to report all your income and pay the income taxes due on it is a crime. It is not a victimless crime, because it increases the burden on those who do comply with the law. If I were to ever consider unretiring, I would only do it to prosecute tax evaders.

Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Because I think it's totally unreasonable to expect to be able to eliminate the underground economy.

Just like it was totally unreasonable to expect prohibition to succeed 100 years ago.

If you don't agree with me, that's fine...

Thanks for the warning.

Irishgirlyc58

Thinks s/he gets paid by the post

- Joined

- Sep 26, 2020

- Messages

- 1,070

Failing to report all your income and pay the income taxes due on it is a crime. It is not a victimless crime, because it increases the burden on those who do comply with the law. If I were to ever consider unretiring, I would only do it to prosecute tax evaders.

Including the wealthy ones?

- Joined

- Apr 14, 2006

- Messages

- 23,113

Yes, especially those ones.Including the wealthy ones?

athena53

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 11, 2014

- Messages

- 7,383

Failing to report all your income and pay the income taxes due on it is a crime. It is not a victimless crime, because it increases the burden on those who do comply with the law..

I agree. It's not just the direct tax burden but the cost of propping them up with needs-based social programs- Section 8 housing, Meals on Wheels, property tax reduction or elimination if they own a home, etc.

ETA: Good to see the OT (unusually high COLA could push more SS recipients into bracket where part of their SS is taxable) getting wider publicity via this article on msn.com.

https://www.msn.com/en-us/money/new...icefeed&cvid=70b7372a579642e8aa5d73ff2de26797

Last edited:

Irishgirlyc58

Thinks s/he gets paid by the post

- Joined

- Sep 26, 2020

- Messages

- 1,070

Irishgirlyc58

Thinks s/he gets paid by the post

- Joined

- Sep 26, 2020

- Messages

- 1,070

My comment about the mental illness was just to explain some of the behavior and decisions people make, that someone else had mentioned. I wasn't implying that mental illness should qualify you for SS.

I worked in social services for 35 years. People make decisions based on their circumstances and knowledge. Sometimes people who don’t have the financial means make decisions people with money don’t understand.

For example they may buy one tire even though they need all 4. But one is all they can afford. So they replace the worst one.

Someone looking at that might say that’s just stupid but the reality is that was the only option.

There are other reasons people without means make the decisions that they do. Human beings are very complicated.

I know [mention]GenXguy [/mention] you weren’t saying these things I’m just piggy backing on your post.

I know a woman who was married to a mafia figure and got divorced. Since all the income was "off the books" she has no Social Security earnings. Her son pays for her expenses and I think she gets SSI, which is like $900 a month. Not a good future ahead for her.

Fortunately, the increasing amounts of Federal income tax on SS income feeds right back into the SS and Medicare trust funds, per this link:

https://www.ssa.gov/oact/progdata/taxbenefits.html

This is a good thing, helping maintain solvency of those two programs.

Note: 85% of my SS benefit has been taxable from the day I started it and always will be under current law...

Basically, it is solvency through decreased benefits, but the decrease in benefits is disguised through increased benefits!

TheWizard

Thinks s/he gets paid by the post

Basically, it is solvency through decreased benefits, but the decrease in benefits is disguised through increased benefits!

Sort of.

For folks like me, who have had 85% of SS included in AGI from the start, it's a non issue.

And a lot of low income retirees will change from zero SS taxable to something less than 50% taxable their first year.

And that's likely in the 10% or 12% Federal bracket, not the 24% marginal bracket I'm in...

Similar threads

- Replies

- 16

- Views

- 824

- Replies

- 15

- Views

- 8K

- Locked

- Replies

- 103

- Views

- 5K

- Replies

- 35

- Views

- 4K