Freedom56

Thinks s/he gets paid by the post

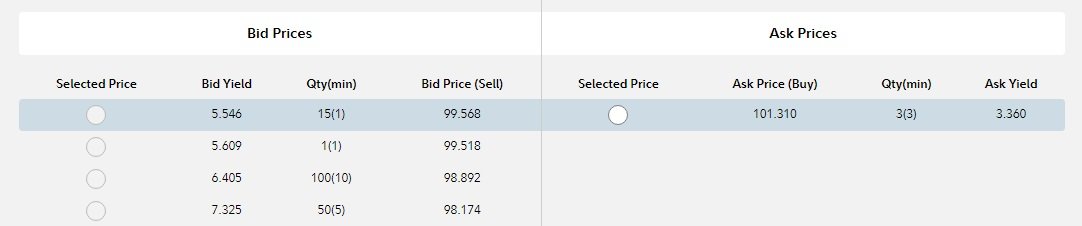

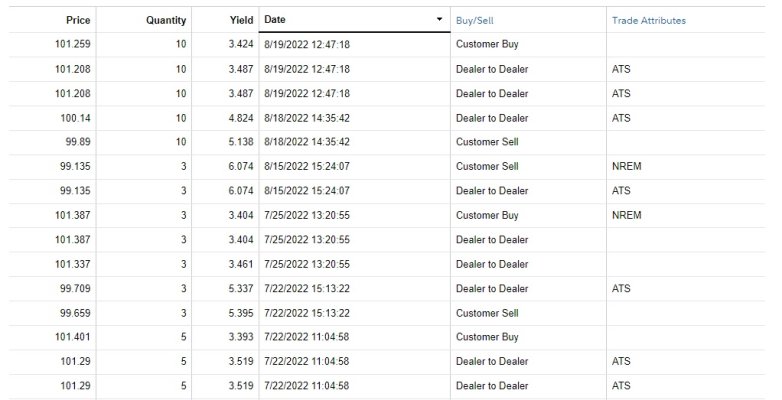

Here is a short term note from Goldman Sachs that has been dropping below par. The coupon is 5% and matures 6/15/23.

Details

CUSIP 38141E2F5

ISIN US38141E2F51

SEDOL --

Pay Frequency MONTHLY

Coupon 5.000

Maturity Date 06/15/2023

Moody's Rating A2

S&P Rating BBB+

The current order book and recent trades are as per the attached images. This is a nice one to pick at at par or lower during the next market sell-off.

Details

CUSIP 38141E2F5

ISIN US38141E2F51

SEDOL --

Pay Frequency MONTHLY

Coupon 5.000

Maturity Date 06/15/2023

Moody's Rating A2

S&P Rating BBB+

The current order book and recent trades are as per the attached images. This is a nice one to pick at at par or lower during the next market sell-off.