copyright1997reloaded

Thinks s/he gets paid by the post

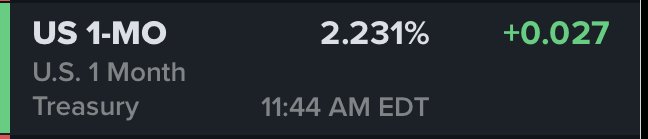

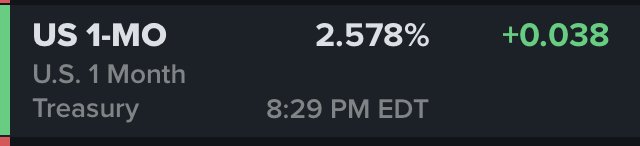

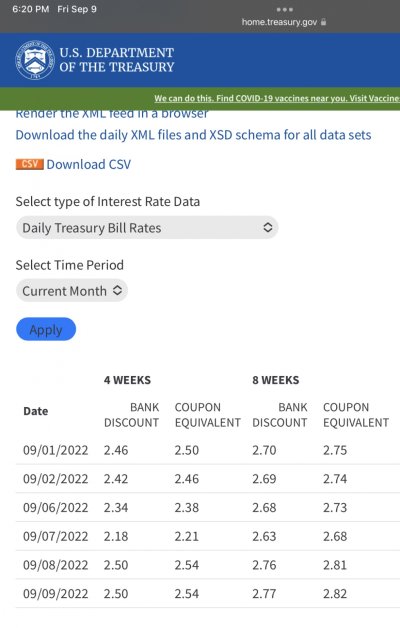

At this point 4 week t-bill is trading around 2.244% as of 11:15am ET this morning. Rate up by 0.040.

Schwab deadline for entering same day auction orders was 9:30am. The US Treasury has an 11:00am deadline for non-competitive orders for the auction, and competitive bidders must have their bids in by 11:30am.

So at this point we can wait for the auction results to be published.

This is EXCITING!

For even more fun I added a sheet to my portfolio tracking spreadsheet to keep my T-bill purchase info. As of now, four purchases, weighted average YTM 3.01%, current weighted days to maturity (as of today) 140.3 days, first maturity 10/4/22.