aja8888

Moderator Emeritus

Never into Crypto, but don't understand how you can go from $32B (or whatever they are reporting now) to ZERO in days.

Well, it didn't just evaporate. It's in a secret bank account(s).

Never into Crypto, but don't understand how you can go from $32B (or whatever they are reporting now) to ZERO in days.

The previous cryptocurrency discussion was closed because “ the topic of cryptocurrency has been covered and exhausted”. The moderator team discussed this thread and felt there was enough new information to allow it. It’s fine long as the discussion remains on topic and doesn’t fall back to a replay of the previous thread.How come the mods are not shutting down this thread which violates the policy against discussing crypto?

Most of the comments are on topic so far, thanks. Let’s please just let the discussion develop.OK.

Just so we are clear, is this thread limited to the fraud committed by Sam Bankman-Fried and his companies FTX and Alameda Research?

Some crypto assets such as Solana have dropped considerably due to SBF selling to attempt to stop the run on the bank. Is this what we are referring to as a meltdown?

If so, I can see that this is a new topic. However, a lot of the posts so far seem to be the same old "crypto is a pile of dung ponzi scheme" comments that we had in the thread that was closed.

Mr. Bankman-Fried embarked on a campaign to amass regulatory licenses. He surprised many of his fans when he came to a December 2021 Capitol Hill hearing on cryptocurrencies, wearing a suit and tie. Soon, he was a frequent visitor to Washington, meeting with regulators and others. [mod edit]

Only as a distant observer. I never got on the crypto bandwagon. I still don't understand it's value.

Some click bait site said Tom and Geselle had 3/4 of the asserts in FTX.

Schadenfreude at its most enjoyable.

Sent from my LM-Q850 using Early Retirement Forum mobile app

For those who have not been following, here is a short summary.

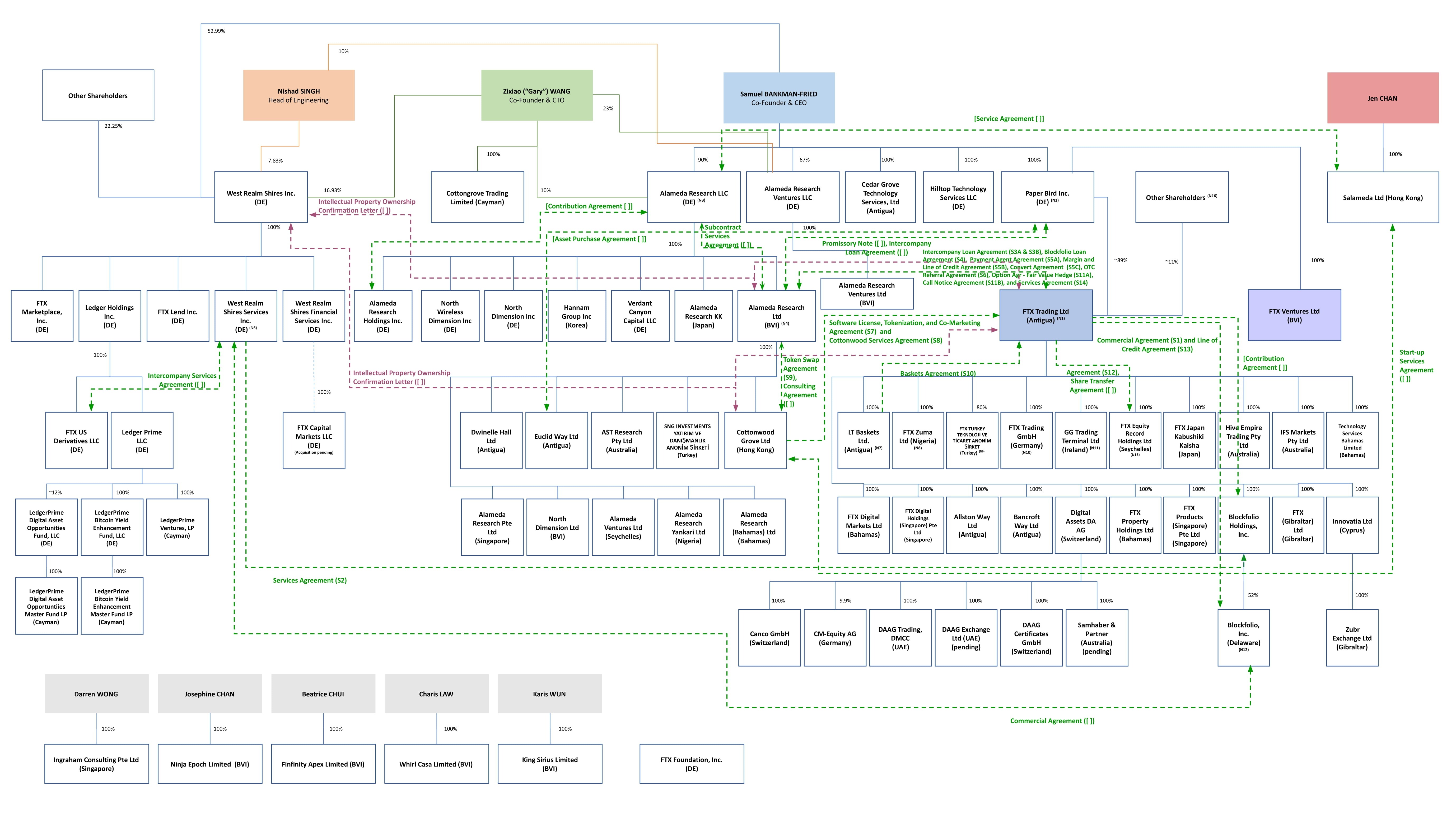

Sam Bankman-Fried is a young billionaire whose companies FTX, FTX.us and Alameda Research (among others) are the main players. FTX is a crypto exchange and Alameda is a trading company or hedge fund.

SBF's mother is a lawyer and a leading fund raiser for the DNC. SBF has been the second largest donor to the Democrat party in the past five years, second only to George Soros.

The CEO of Alameda Research is the daughter of the head of economics at MIT. Her father was the boss of Gary Gensler when he taught at MIT.

SBF has been heavily lobbying and working with Gensler on the pending crypto regulation bill.

There is a Chinese guy called CZ who runs the Binance exchange. He found out that SBF was using his political connections to stick it to his competitors with his lobbying.

A while ago there was a company called Celsius Network that was basically a ponzi scheme where people deposited crypto for large interest rates. Celsius was found out and went bankrupt along with another company called 3 Arrows Capital.

Unknown to the world, Alameda Research had gotten into trouble with the Celsius meltdown and had liquidity problems. It seems that SBF committed fraud or some other crime by sending FTX customer deposit funds to prop up Alameda Research.

FTX had printed its own money called the FTT token out of thin air and was using this as collateral for loans. CZ had been the initial investor in FTX and had a large amount of FTT token from the split up.

CZ got mad at SBF and tweeted that he was going to sell millions of FTT tokens. This caused a bank run on the FTX exchange, which did not have enough customer deposit funds to meet the withdrawals. A crypto exchange is not allowed to do fractional reserve banking. It is required to maintain a 1 to 1 backing of customer deposits.

As everyone owning the FTT token freaked out and started selling, the price crashed and since FTX held a large amount of its reserves as FTT token it became illiquid or insolvent. FTX had to start selling its other assets to prop up the price of the FTT token.

Note the similarity between various countries having to sell U.S Treasuries to buy their own currency to prop it up due to U.S interest rate hikes.

Of course SBF told everyone that things were rosy.

Then he had to ask CZ to help him. CZ signed a non-binding letter of intent to buy FTX but then backed out.

Next thing you know FTX, FTX.us, Alameda Research and over 100 subsidiaries filed for bankruptcy.

Friday night at 10pm, massive amounts of crypto assets were sent out from FTX and FTX.us. FTX said they were being hacked. User accounts were drained along with FTX reserve accounts.

The Kraken crypto exchange has very good technicians and is claiming to know the identity of the person that did the transfer because they used Kraken as a transfer point for some of the assets.

The general feeling is that this was an inside job, either SBF with associates or some other employees.

So, basically, this is not a meltdown of crypto, but it is an instance of criminal activity by a centralized finance firm. I think it was Larry Summers that said this was more like an Enron event than a Lehman Brothers event.

At the moment there are rumors that SBF has been taken into custody in the Bahamas where where he lives and runs the FTX international company from.

I find this very interesting how CZ was able to trigger the run on the FTT token and the FTX withdrawals. The All-In Podcast this week said that this is similar to what hedge funds will do to each other when one is caught off balance with a heavy short position.

The exchange's founder Sam Bankman-Fried secretly transferred $10 billion of customer funds from FTX to Bankman-Fried's trading company Alameda Research, the people told Reuters.

A large portion of that total has since disappeared, they said. One source put the missing amount at about $1.7 billion. The other said the gap was between $1 billion and $2 billion.

...Now Charlie is saying Real returns in the market are going to be lower for the next decade. ..He talks of a 5% return and with 7% inflation you actually have a neg 2 return..Oh Charlie .

It's possible this was actually a hack, but there have been many other examples in crypto failures where 'hack' is just the weak cover story for a "rug pull" or inside job of embezzlement.Apparently yesterday FTX was hacked and some customers' crypto was just spirited away somewhere.

...

FTX had printed its own money called the FTT token out of thin air and was using this as collateral for loans. CZ had been the initial investor in FTX and had a large amount of FTT token from the split up.

CZ got mad at SBF and tweeted that he was going to sell millions of FTT tokens. This caused a bank run on the FTX exchange, which did not have enough customer deposit funds to meet the withdrawals. A crypto exchange is not allowed to do fractional reserve banking. It is required to maintain a 1 to 1 backing of customer deposits.

As everyone owning the FTT token freaked out and started selling, the price crashed and since FTX held a large amount of its reserves as FTT token it became illiquid or insolvent. FTX had to start selling its other assets to prop up the price of the FTT token.

...

And how do people value Bitcoins? Answer: in $'s.