pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

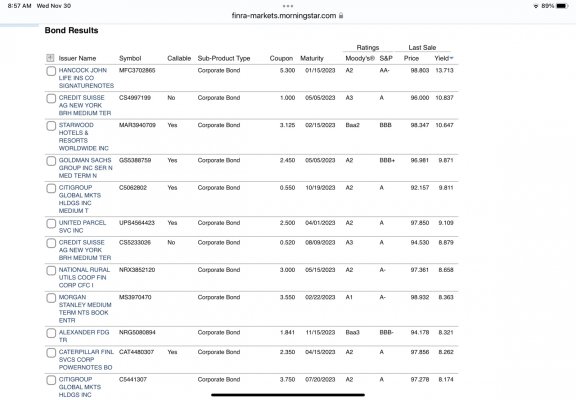

Note the settlement date on this is 12/21 and won't start accruing interest until then.

Yeah, I got caught on that one, not realizing that it won't settle until 12/21. If the purchase was at Vanguard or Fido it would not be a big deal because the settlement account earns decent interest, but at Schwab the settlement account only yields 0.4% so I'll have $100k sitting there not doing much of anything until Dec 21. So I'm going to call and see if I can cancel the buy and I'll either buy something else or buy it closer to settlement if it is still available.

Lesson learned to pay attention to funding timing for new issues.