copyright1997reloaded

Thinks s/he gets paid by the post

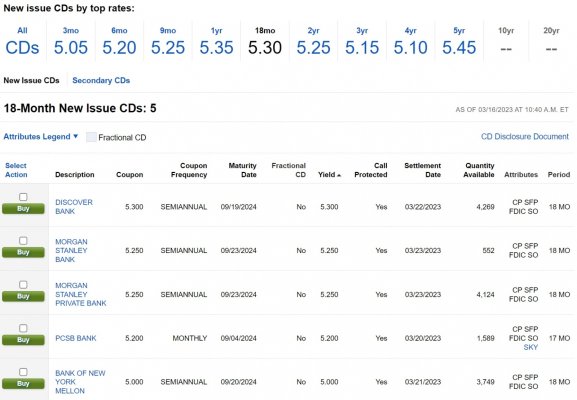

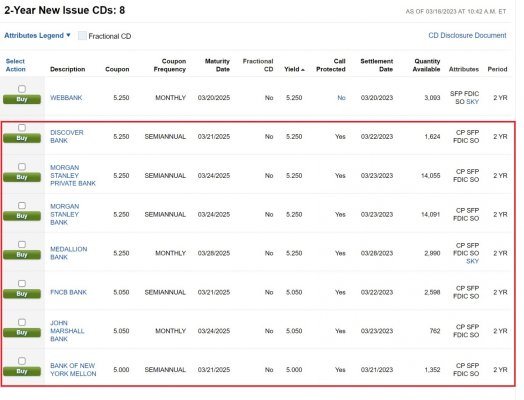

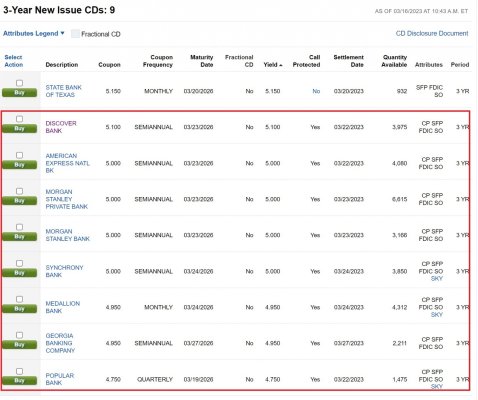

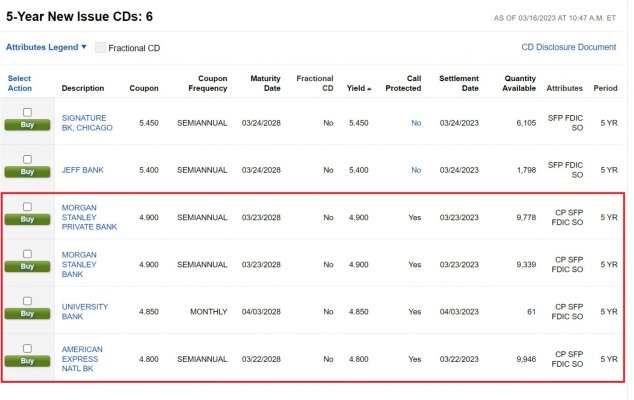

Not with an inverted yield curve I think.

It is more difficult with an inverted yield curve because typically banks lend (assets) longer than their deposits (liabilities). Thus, an inverted yield hurts ... especially when what they have to pay on those short duration deposits goes up dramatically in a year!

(Banks also make spread for a given time frame, i.e. they should borrow (e.g. CDs) at a rate lower than what they loan it for. For example, they would pay less for a 5-year CD than what they get on a 5-year auto loan.