OP - sounds like your advisor does the buying for you.

I buy my own stocks and bonds, in a self managed account and don't pay a yearly fee for that privilege.

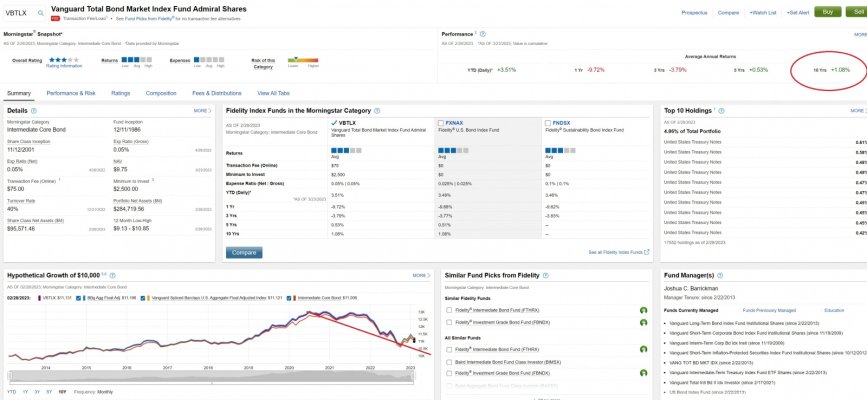

I have learned, going forward, I'll not buy bond funds again. I got to enjoy some bond fund lowering of NAV like lots of people.

It's just as easy to buy Treasuries, CD's, or bonds of very safe companies like a few banks.

I'll keep enough money short term, to not have to sell the bonds at a loss, so not lose my principal.

Thanks, actually no, i do all trades myself. Just get input from him… Bond fund rule of thumb being that i dont lose the $$ if i hold them long enough….i think i’ll be ok… the market is just particularly frustrating now. And of course that applies to all sectors. I went heavier into Small Cap beginning early this year and was enjoying the rise only to watch all gains and then some wiped out in that ETF in the past week or so,…