You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

We are entering a "Golden Period" for fixed income investing

- Thread starter Freedom56

- Start date

- Status

- Not open for further replies.

Freedom56

Thinks s/he gets paid by the post

First Republic Bank Is Seized, Sold to JPMorgan

"JPMorgan said it will assume all of First Republic’s $92 billion in deposits—insured and uninsured. It is also buying most of the bank’s assets, including about $173 billion in loans and $30 billion in securities.

As part of the agreement, the Federal Deposit Insurance Corp. will share losses with JPMorgan on First Republic’s loans. The agency estimated that its insurance fund would take a hit of $13 billion in the deal. JPMorgan also said it would receive $50 billion in financing from the FDIC"

https://www.wsj.com/articles/first-...an-in-second-largest-u-s-bank-failure-5cec723

"JPMorgan said it will assume all of First Republic’s $92 billion in deposits—insured and uninsured. It is also buying most of the bank’s assets, including about $173 billion in loans and $30 billion in securities.

As part of the agreement, the Federal Deposit Insurance Corp. will share losses with JPMorgan on First Republic’s loans. The agency estimated that its insurance fund would take a hit of $13 billion in the deal. JPMorgan also said it would receive $50 billion in financing from the FDIC"

https://www.wsj.com/articles/first-...an-in-second-largest-u-s-bank-failure-5cec723

Freedom56

Thinks s/he gets paid by the post

Canadian banks are the safest followed by the large U.S. center banks (too big to fail banks). Canadian banks have higher capital requirements than their U.S. counterparts. They are also more diversified in banking, wealth management, and insurance. I would avoid the regional banks. Banks are all about trust and confidence. We live in a world where money can be wired out of an account within an hour. Right now payroll processors are requesting companies move their accounts out regional banks to the larger banks. Like it or not, the change to the capital requirements and oversight enacted in 2018 have made regional banks much more vulnerable. Many are over-leveraged. Un-insured deposits are going to continue to migrate to larger banks.

Canadian banks will start reporting earnings in a few weeks.

Canadian banks will start reporting earnings in a few weeks.

Last edited:

As I learn more about individual bonds, one thing I can't reconcile very easily is the fact that a lot of very strong companies have bonds rated down below baa1/BBB+. For example, Juniper Networks. I can't see them defaulting on bonds in the next 5-8 years, but they are down in the area just above non-investment grade. That surprises me. There are a lot of companies like that.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

As I learn more about individual bonds, one thing I can't reconcile very easily is the fact that a lot of very strong companies have bonds rated down below baa1/BBB+. For example, Juniper Networks. I can't see them defaulting on bonds in the next 5-8 years, but they are down in the area just above non-investment grade. That surprises me. There are a lot of companies like that.

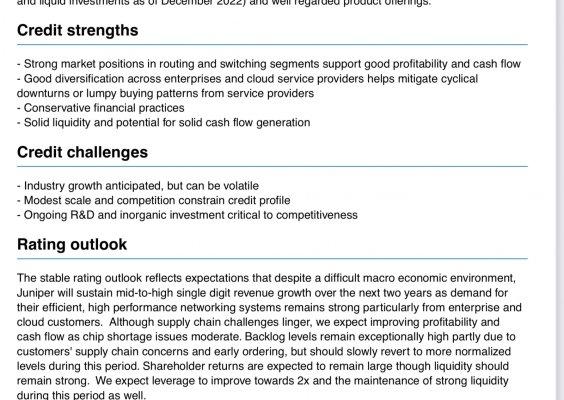

If you read the Moody’s reports, which Fidelity links to each bond listing where available, you see why they are rated what they are. As an example, here is one for Juniper.

Attachments

Last edited:

Car-Guy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Maybe because they (Juniper) directly compete with mega giant Cisco.As I learn more about individual bonds, one thing I can't reconcile very easily is the fact that a lot of very strong companies have bonds rated down below baa1/BBB+. For example, Juniper Networks. I can't see them defaulting on bonds in the next 5-8 years, but they are down in the area just above non-investment grade. That surprises me. There are a lot of companies like that.

If you read the Moody’s reports, which Fidelity links to each bond listing where available, you see why they are rated what they are. As an example, here is one for Juniper.

Yes, I've been reading the reports. I just know that market space pretty well, having worked in it for many years. I guess what's strange to me is that the implication that a lot of these large tech companies are barely investment grade seems to be unduly negative about their ability to pay their bills over the next several years. I realize technological obsolescence is always a risk, but usually it takes a long, long time before a major tech company gets dropped into the waste basket, ala Kodak, DEC, etc.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Maybe because they (Juniper) directly compete with mega giant Cisco.Although Juniper does have great products.

That is more or less what Moody’s says as well. Their scale compared to the competition puts them at risk.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Yes, I've been reading the reports. I just know that market space pretty well, having worked in it for many years. I guess what's strange to me is that the implication that a lot of these large tech companies are barely investment grade seems to be unduly negative about their ability to pay their bills over the next several years. I realize technological obsolescence is always a risk, but usually it takes a long, long time before a major tech company gets dropped into the waste basket, ala Kodak, DEC, etc.

It’s still investment grade.

Freedom56

Thinks s/he gets paid by the post

There are many corporations rated BAA1/BBB+ like eBay that a stable businesses that generate a lot of cash and that continue to take market share from larger retailers. E-commerce is not going away. Many companies with well known brands, use eBay to liquidate overstock and refurbished items rather than sell them to third party liquidators.

Freedom56

Thinks s/he gets paid by the post

From Barron's today:

First Republic Deal Is a Coup for Jamie Dimon and JPMorgan

"Put simply, JPMorgan is receiving about $186 billion of assets and assuming $168 billion of liabilities, getting a net $18 billion of assets while paying $10.6 billion to the Federal Deposit Insurance Corp. That looks like a gain of almost $8 billion, although the bank will recognize just $2.6 billion initially and will absorb $2 billion of restructuring costs in 2023 and 2024. "

https://www.barrons.com/articles/stock-market-volatility-tech-risk-6cf00fe0

First Republic Deal Is a Coup for Jamie Dimon and JPMorgan

"Put simply, JPMorgan is receiving about $186 billion of assets and assuming $168 billion of liabilities, getting a net $18 billion of assets while paying $10.6 billion to the Federal Deposit Insurance Corp. That looks like a gain of almost $8 billion, although the bank will recognize just $2.6 billion initially and will absorb $2 billion of restructuring costs in 2023 and 2024. "

https://www.barrons.com/articles/stock-market-volatility-tech-risk-6cf00fe0

Mulligan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 3, 2009

- Messages

- 9,343

We are entering a "Golden Period" for fixed income investing

Yes, you have to read the report to understand why it is rated as such. Which also reinforces ratings are just subjective models, not just “numbers”. For example Rexford which is an industrial reit in BBB area is notched downward from “concentration risk” (most buildings in S. Cal area) and in past from “lack of years in public debt market”. So if it was “just the math” it would be rated higher.

Pacific Gas and Electric is another example. Moodys just stated it has been put on “positive” outlook from stable. This means it could be in line for a credit upgrade soon. Moodys already stated the finances of the company should merit a higher rating, but other factors (fire risk, at times hostile regulatory/legislative, etc.) have held back the rating upgrade.

If you read the Moody’s reports, which Fidelity links to each bond listing where available, you see why they are rated what they are. As an example, here is one for Juniper.

Yes, you have to read the report to understand why it is rated as such. Which also reinforces ratings are just subjective models, not just “numbers”. For example Rexford which is an industrial reit in BBB area is notched downward from “concentration risk” (most buildings in S. Cal area) and in past from “lack of years in public debt market”. So if it was “just the math” it would be rated higher.

Pacific Gas and Electric is another example. Moodys just stated it has been put on “positive” outlook from stable. This means it could be in line for a credit upgrade soon. Moodys already stated the finances of the company should merit a higher rating, but other factors (fire risk, at times hostile regulatory/legislative, etc.) have held back the rating upgrade.

JoeWras

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 18, 2012

- Messages

- 11,725

I realize technological obsolescence is always a risk, but usually it takes a long, long time before a major tech company gets dropped into the waste basket, ala Kodak, DEC, etc.

Any ex Nortel employees willing to chime in?

Any ex Nortel employees willing to chime in?

What would you like to know? #exnortel.

He was ribbing about companies going extinct. #exdsc #exalcatelWhat would you like to know? #exnortel.

Sent from my moto g power using Early Retirement Forum mobile app

JoeWras

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 18, 2012

- Messages

- 11,725

Yes, sorry for being obtuse. I did not work at Nortel, I had a lot of friends who did. They had a large presence in North Carolina. Some of my friends made serious mistakes with company stock and it ruined their chance at ER.

Nortel did not take a long, long time to go away. Their demise was shockingly fast in just a few year's period in the early 2000s. Granted, part of it was the tech shock, but it wasn't all about the tech crash. There were management issues that didn't anticipate the competition, among other issues.

Nortel did not take a long, long time to go away. Their demise was shockingly fast in just a few year's period in the early 2000s. Granted, part of it was the tech shock, but it wasn't all about the tech crash. There were management issues that didn't anticipate the competition, among other issues.

Last edited:

Yes, sorry for being obtuse. I did not work at Nortel, I had a lot of friends who did. They had a large presence in North Carolina. Some of my friends made serious mistakes with company stock and it ruined their chance at ER.

Nortel did not take a long, long time to go away. Their demise was shockingly fast in just a few year's period in the early 2000s. Granted, part of it was the tech shock, but it wasn't all about the tech crash. There were management issues that didn't anticipate the competition, among other issues.

Ah right. I worked for Nortel for several years, and yes they did implode pretty quickly. I got to know the CEO John Roth a bit along with others in the executive staff. They imploded after I left, but having worked for many companies since I realized that the talent at Nortel was amazing, but the management was horrifically bad. So, I guess the takeaway for bond investors is that one bad management team can wipe out over 100 years of history in a flash.

Apologize upfront for this question that has likely been asked and answered. This thread however is both long and much appreciated.

I am ready to make another bond investment which will coincide with the next Fed rate increase action. Is there a preferred timing to buy new issue CDs and/or corporate bonds based upon the Feds action? Or, is it as simple as buy before the rate is reduced at some future date.

Thanks as always.

I am ready to make another bond investment which will coincide with the next Fed rate increase action. Is there a preferred timing to buy new issue CDs and/or corporate bonds based upon the Feds action? Or, is it as simple as buy before the rate is reduced at some future date.

Thanks as always.

copyright1997reloaded

Thinks s/he gets paid by the post

Apologize upfront for this question that has likely been asked and answered. This thread however is both long and much appreciated.

I am ready to make another bond investment which will coincide with the next Fed rate increase action. Is there a preferred timing to buy new issue CDs and/or corporate bonds based upon the Feds action? Or, is it as simple as buy before the rate is reduced at some future date.

Thanks as always.

Rates can go either way. You place your bet and take your chances. (I am buying some of the 4-month T-Bill at auction today.)

On the CD front, you *might* be able to buy now (brokered) and cancel later today after the Fed results. (Assuming rates start going up.) They typically can be cancelled until a) a specific date or b) orders are filled. In terms of buying afterwards, if it is available before and you jump quickly, you might be able to buy later this afternoon (assuming a scenario where rates go down) unless others quickly grab whats left of the CD offering before you.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Apologize upfront for this question that has likely been asked and answered. This thread however is both long and much appreciated.

I am ready to make another bond investment which will coincide with the next Fed rate increase action. Is there a preferred timing to buy new issue CDs and/or corporate bonds based upon the Feds action? Or, is it as simple as buy before the rate is reduced at some future date.

Thanks as always.

The ultra short end is affected by the Fed. The rest of the curve, less so and mainly driven by the market. Short term has been rising, but not as high as it once was. Intermediate and long have been dropping.

KCGeezer

Thinks s/he gets paid by the post

- Joined

- Jan 2, 2015

- Messages

- 1,539

We are entering a "Golden Period" for fixed income investing

Looking to the experts to ask a valuation question. I purchased a Comcast bond (20030NBL4 ) and now It is the first bond that I’ve had to receive a voluntary tender offer. Per the offer

As a holder of the 3.375% Notes due 2025, for each $1,000 principal amount you

validly tender, you will be eligible to receive:

1. A total cash payment to be determined by reference to the fixed spread of +5

basis points plus the yield based upon the bid side price of the 2.00% UST due

2/15/25, as quoted on page FIT4 on the Bloomberg reference bond trader series

of pages at 11:00 a.m., New York City time, on 5/5/23, the price determination

date.

Can I back into the expected net sale price if I agree to sell?

Edit - After long discussion with Fidelity bond desk the best guess would be somewhere around $978 per bond. (1000 * .968) + (1000*.0375*.25). Bond value * current price of reference+.05 + 90 days interest at the 3.75 coupon.

Think I’ll pass.

Looking to the experts to ask a valuation question. I purchased a Comcast bond (20030NBL4 ) and now It is the first bond that I’ve had to receive a voluntary tender offer. Per the offer

As a holder of the 3.375% Notes due 2025, for each $1,000 principal amount you

validly tender, you will be eligible to receive:

1. A total cash payment to be determined by reference to the fixed spread of +5

basis points plus the yield based upon the bid side price of the 2.00% UST due

2/15/25, as quoted on page FIT4 on the Bloomberg reference bond trader series

of pages at 11:00 a.m., New York City time, on 5/5/23, the price determination

date.

Can I back into the expected net sale price if I agree to sell?

Edit - After long discussion with Fidelity bond desk the best guess would be somewhere around $978 per bond. (1000 * .968) + (1000*.0375*.25). Bond value * current price of reference+.05 + 90 days interest at the 3.75 coupon.

Think I’ll pass.

Last edited:

Freedom56

Thinks s/he gets paid by the post

TD Bank calls off merger with First Horizon. This is good news for TD Bank as they were overpaying based on a price set early last year. TD Bank shareholders were urging the bank to terminate the deal after the deposit flight at First Horizon.

https://www.wsj.com/articles/toront...inate-merger-agreement-38d58b35?siteid=yhoof2

https://www.wsj.com/articles/toront...inate-merger-agreement-38d58b35?siteid=yhoof2

- Status

- Not open for further replies.

Similar threads

- Replies

- 35

- Views

- 3K

- Replies

- 3

- Views

- 474

- Replies

- 17

- Views

- 773