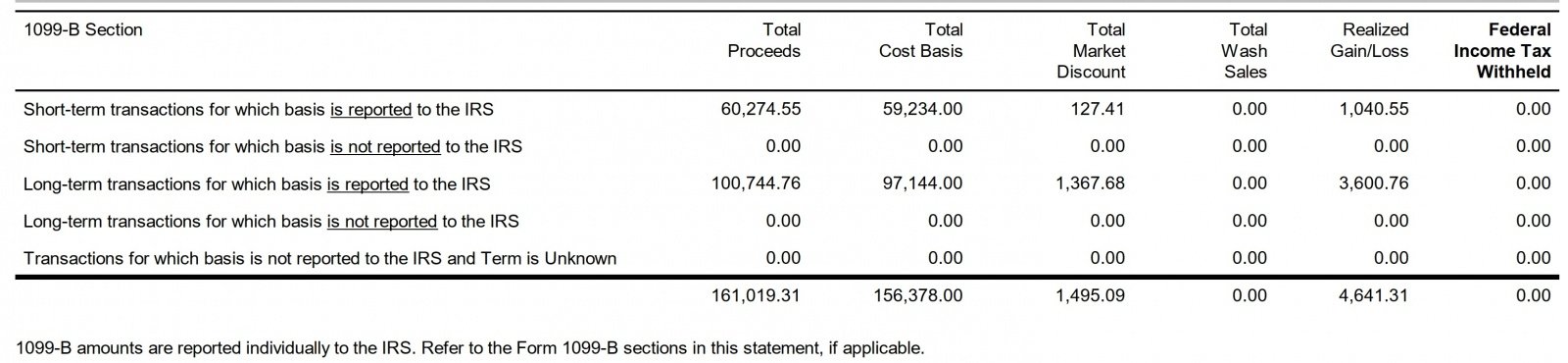

I don't think the document is wrong. What is wrong is the idea that ANY gain on a bond held for more than a year bond is ALWAYS taxed at capital gains rates. If you buy at a deep enough discount (lower than the di minimis threshold of .25% per year left to maturity, call, or sale), any gain (up to par) is treated as imputed interest (payable yearly in pieces or in lump sum at the end (maturity or sale)), and taxed as interest income at ordinary rates. Gains beyond that are taxed at normal capital gains rates (short- or long-term depending on holding period).

Fidelity has a fairly clear paper on it here:

https://www.fidelity.com/bin-public...documents/fixed-income/de-minimis-dilemma.pdf

These guys are the real tax experts. The give advice to CPAs.

https://www.thetaxadviser.com/issues/2007/oct/taxtreatmentofmarketdiscountbonds.html

Though it is usually discussed in a municipal bond context (because it makes the most difference there), it applies to all bonds (debt instruments). Not entirely sure what happens with Treasuries, though. Complicated for sure.