Texas Proud

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 16, 2005

- Messages

- 17,356

, no matter what, unless the issuer goes bankrupt and then you are at the front of the line in bankruptcy. That's a lot more security than you will ever have from a stock.

!

Actually you are not even close to the front of the line with normal unsecured bonds...

You have DIP financing, secured loans, administrative costs, tax liens, employee claims and maybe more before getting to unsecured claims...

You are above preferred and common stock but that is about it...

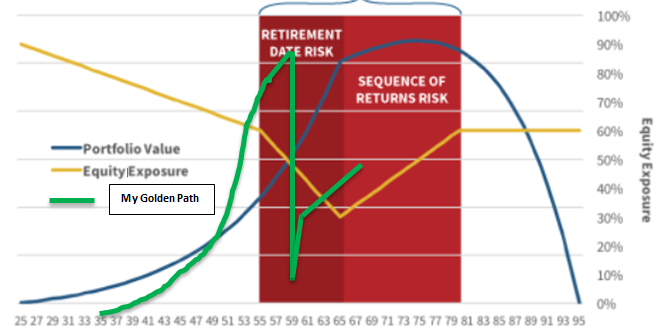

which happened to be Dec '19 for me.

which happened to be Dec '19 for me.