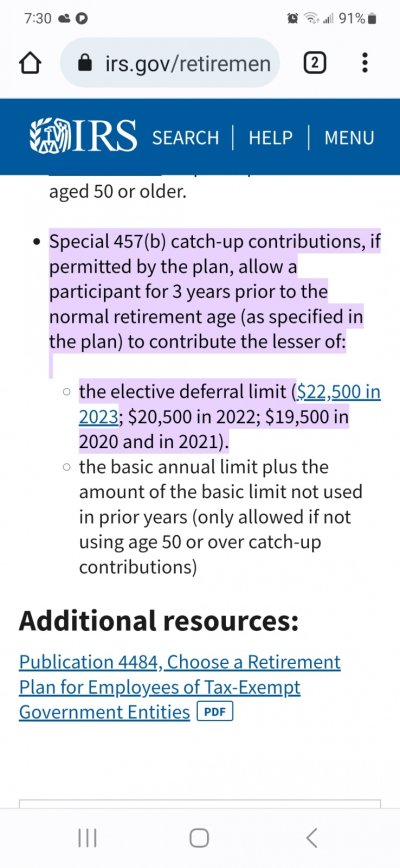

Just curious how others read this. In the past the 3 year catch up provision for a 457 was double the max for the year if you had underfunded the plan in the past. So, if I missed maxing out the plan I could add more money into it, maxed at 2x the anual contributions for the three years prior to retirement. Now, in 2023, it reads as if I can contribute more then 2x the max, for as much as I underfunded the account previously? If this is correct, this saves me this year. I am retiring in August, and have extra to put in this account to bring my tax bracket down. Am I missing something?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

457 b 3 year catch up plan

- Thread starter Slim11

- Start date

Irishgirlyc58

Thinks s/he gets paid by the post

- Joined

- Sep 26, 2020

- Messages

- 1,065

I hope someone much more knowledgeable than I am responds to your question.

If I recall correctly my 457b plan allowed for $39,000 max contributions in the 3 years before retirement. This was stated on the form needed to be completed for the payroll deduction. Our auditors office would not have allowed an amount higher than this but I retired in 2021.

I read the section you posted but I thought it said the lesser of the 2 was allowed?

My advice would be contact either your HR/payroll department or the 457b plan provider for your plans specifics.

If I recall correctly my 457b plan allowed for $39,000 max contributions in the 3 years before retirement. This was stated on the form needed to be completed for the payroll deduction. Our auditors office would not have allowed an amount higher than this but I retired in 2021.

I read the section you posted but I thought it said the lesser of the 2 was allowed?

My advice would be contact either your HR/payroll department or the 457b plan provider for your plans specifics.

I understand what it was, but the IRS site make it look like it changed? I have asked people, and they are much less knolagable then say a rock. Lol. The plan people didnt even know what a 3 year catch up was and HR said I could do it for one year. So, thats where I am at.

Irishgirlyc58

Thinks s/he gets paid by the post

- Joined

- Sep 26, 2020

- Messages

- 1,065

I understand what it was, but the IRS site make it look like it changed? I have asked people, and they are much less knolagable then say a rock. Lol. The plan people didnt even know what a 3 year catch up was and HR said I could do it for one year. So, thats where I am at.

Why am I not surprised!

It’s unbelievable what people who are supposed to be experts in their field don’t know. They at least should know who does have the answer.

I think someone here will know. Cathy63? I think that’s her name here, she knows a lot about taxes.

You might tag her.

Morgan22

Recycles dryer sheets

Call the custodian of the plan if HR is not aware of the catch up provisions. Or ask HR to see the plan docs. My understanding is that 457b plans MAY offer this benefit, but are not required to. But, I haven't heard of a governmental plan yet that hasn't offered it. yet...

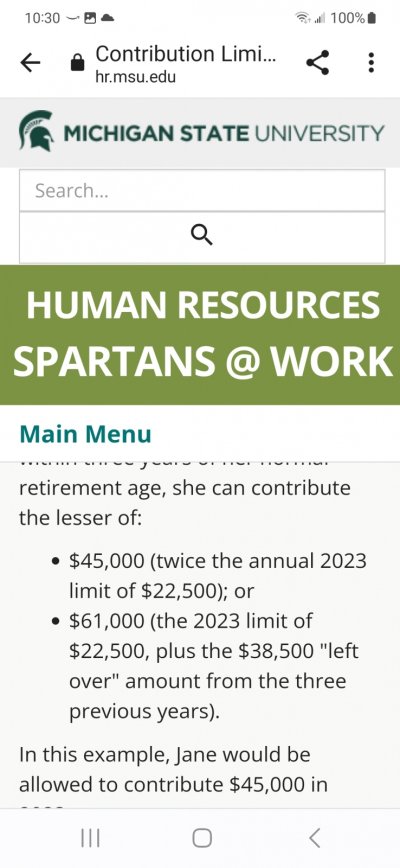

I like this example showing how the catch up works. https://hr.msu.edu/benefits/retirement/457-def-limits.html

Maybe forward this to your HR rep? I've also found that usually the HR staff does not understand details of benefit packages, but as you go higher up the chain, you get folks that are more knowledgeable about benefits. If you have a VP of benefits maybe you could email them directly.

I like this example showing how the catch up works. https://hr.msu.edu/benefits/retirement/457-def-limits.html

Maybe forward this to your HR rep? I've also found that usually the HR staff does not understand details of benefit packages, but as you go higher up the chain, you get folks that are more knowledgeable about benefits. If you have a VP of benefits maybe you could email them directly.

That example shows exactly what I am asking and how I interpreted the new law. Last year it was doubble, but now its the limit plus any underfunding. Now , I just have to get someone on the plan side to see it that way. Or, open a second account, and dump the remainder in thier. So, I have some work to do.Call the custodian of the plan if HR is not aware of the catch up provisions. Or ask HR to see the plan docs. My understanding is that 457b plans MAY offer this benefit, but are not required to. But, I haven't heard of a governmental plan yet that hasn't offered it. yet...

I like this example showing how the catch up works. https://hr.msu.edu/benefits/retirement/457-def-limits.html

Maybe forward this to your HR rep? I've also found that usually the HR staff does not understand details of benefit packages, but as you go higher up the chain, you get folks that are more knowledgeable about benefits. If you have a VP of benefits maybe you could email them directly.

I did the 3 year catch-up some years ago. It is hard to read that IRS description but it still looks like, if your plan allows it, you can (in each of the three years in the 3 year period) defer double the regular annual deferral for that year, but your special deferrals over the 3 years cannot total more than you left on the table in earlier years. You can’t do both the special 3 year, 2x deferral and the regular over age 50 catch-up in the same year. But if you do the 3 year, 2x catch-up period, and then you continue to work after that, after what could have been your retirement age, you can go back to doing the age 50 catch-ups…

Definitely need to check with your plan to be sure of the rules for your plan.

Definitely need to check with your plan to be sure of the rules for your plan.

Click on it and it will be clear. Yes, the norm before was 2x the annual number. But now it looks diffrent. And you are correct, you dont need to retire. Just be of age. The plan, and I called 3 times still states they will only do 2x the anual contribution limit. Thats ok. IF , AS i read it , the 2023 numbers can be any underfunded liability, I will open a plan in another provider, and put the rest of the money in that. Then, roll it over after I retire in a few months, or whenever I can without penalty to my main plan. The reason I want it in my main plan is a guaranteed 4 percent intrest rate. Not great now, but it never changes. And 4 percent is what I am going for.

I guess we are reading the same language differently; it looks like the 2x is still the total max any given year. The special additional amount is the lesser of a second annual contribution or the amount left on the table in prior years. (But leave it to the IRS to give us confusing wording.)

I’ll be interested to hear what your plan finally tells you.

I’ll be interested to hear what your plan finally tells you.

My plan says 2x the amount. The example posted above by Michigan state says how I read it.

https://hr.msu.edu/benefits/retirement/457-def-limits.html

There in lies the problem. My plan may not allow it, but it looks like its allowed. And I want to do it. So, i must go outside the plan.

https://hr.msu.edu/benefits/retirement/457-def-limits.html

There in lies the problem. My plan may not allow it, but it looks like its allowed. And I want to do it. So, i must go outside the plan.

Attachments

I see what I posted, but the example does not reflect that. And I refer you to my first post. The IRS website definition as of 2023. Its really confusing. The IRS also posted the lesser then gave 2 parameters that have to be added together. So that would mean anything is fair game if you have not contributed it. I will call them tomorrow and see if I get through.

I see what I posted, but the example does not reflect that. And I refer you to my first post. The IRS website definition as of 2023. Its really confusing. The IRS also posted the lesser then gave 2 parameters that have to be added together. So that would mean anything is fair game if you have not contributed it. I will call them tomorrow and see if I get through.

Sorry, to add if it dosent read like that then its just a normal contrabution?