baseman250

Recycles dryer sheets

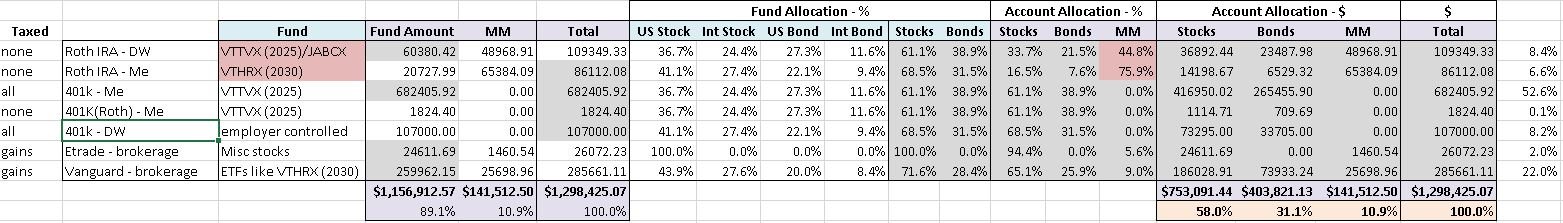

See attachment.

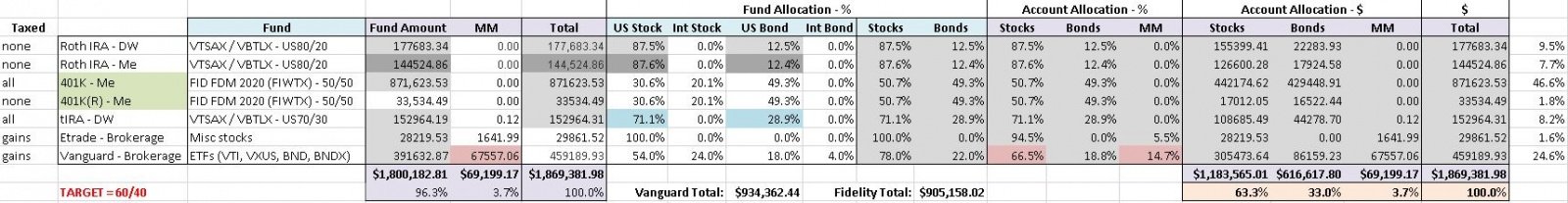

This is pretty much everything. I feel I'm weak in understanding when it comes to the "bond" side of things, and I'm ~11% in MM. The Roth IRAs are heavy in MM because they were moved into Vanguard last year and I've been waiting for an opportunity to shift into VTTVX and/or VTHRX. I feel like I'm missing out on returns by being MM heavy, but maybe this is a good thing right now...?

I also started contributing ROTH dollars inside my 401K this year. I wish I would have done that sooner. Anyway...

I estimate another $75K will hit these accounts over the next two years. Question isn't if I can retire in two years, but if I do, would you change AA?

--Baseman250

This is pretty much everything. I feel I'm weak in understanding when it comes to the "bond" side of things, and I'm ~11% in MM. The Roth IRAs are heavy in MM because they were moved into Vanguard last year and I've been waiting for an opportunity to shift into VTTVX and/or VTHRX. I feel like I'm missing out on returns by being MM heavy, but maybe this is a good thing right now...?

I also started contributing ROTH dollars inside my 401K this year. I wish I would have done that sooner. Anyway...

I estimate another $75K will hit these accounts over the next two years. Question isn't if I can retire in two years, but if I do, would you change AA?

--Baseman250