Free_at_49

Recycles dryer sheets

- Joined

- May 7, 2005

- Messages

- 132

I read both ACA threads and I’m very confused. I grew up in Canada and have lived in 3 EU countries for 16 years. All these countries have universal health care, there are no forms, no applications, no billing, and your coverage is as guaranteed as your right to vote.

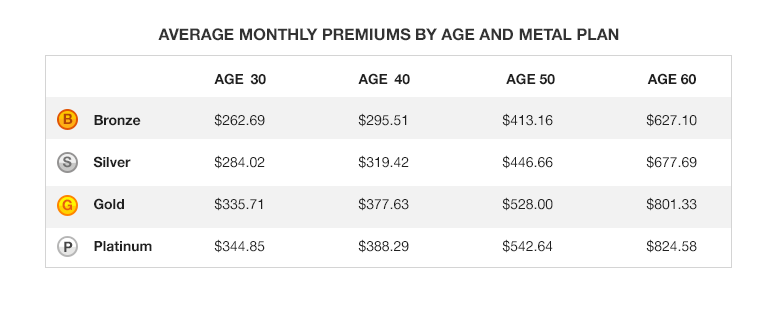

The big picture: I have an $800/month Blue-Cross health insurance for which I’m only paying $200. So that gives the impression that the Fed is throwing in the extra $600, thereby subsidizing insurance companies with taxpayer money. Is this what ACA is doing?!

Also, since I first signed up last year, I started receiving a series of threatening letters. First, ACA wanted me to prove that I’m a US citizen, or they would cancel my health coverage. Next they wanted me to prove my income because there was some deviation from my original estimate, again with a threat of cancellation. They make you feel like you have to prove that you’re poor, so that you can qualify for some charity.

Also, health care and taxation are unrelated matters in other countries, but here they’ve managed to connect them. What exactly are the tax forms I got from the federal exchange? Do they add the “subsidy” to you taxable income, effectively taking back some of it?

Please explain.

The big picture: I have an $800/month Blue-Cross health insurance for which I’m only paying $200. So that gives the impression that the Fed is throwing in the extra $600, thereby subsidizing insurance companies with taxpayer money. Is this what ACA is doing?!

Also, since I first signed up last year, I started receiving a series of threatening letters. First, ACA wanted me to prove that I’m a US citizen, or they would cancel my health coverage. Next they wanted me to prove my income because there was some deviation from my original estimate, again with a threat of cancellation. They make you feel like you have to prove that you’re poor, so that you can qualify for some charity.

Also, health care and taxation are unrelated matters in other countries, but here they’ve managed to connect them. What exactly are the tax forms I got from the federal exchange? Do they add the “subsidy” to you taxable income, effectively taking back some of it?

Please explain.