Independent

Thinks s/he gets paid by the post

- Joined

- Oct 28, 2006

- Messages

- 4,629

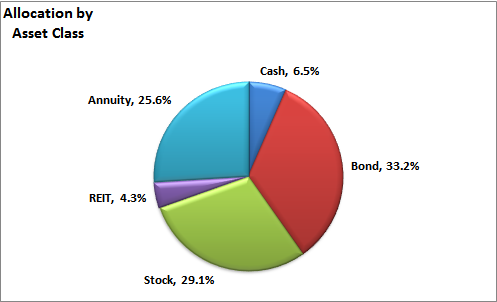

Thanks.Partly trying to understand things myself, partly trying to help my MIL understand how an investment strategy addresses risk. She vividly remembers her DH talking about how much of their retirement they lost in 2008. When I first started helping her, she wanted no money in stocks (and that's pretty much where they were/are). I'm trying to use s/b ratio language to explain to her that (for example) 80/20 is indeed risky, but 30/70 is much less so and has more potential for beating inflation than 0/100. I'm including the /c category to help her understand the importance of having emergency funds available, but also to explain to her about inflation risk.

So I'm back to my earlier post. pb4uski had a good point. "Cash" could mean just the balance in a checking account and currency in the dresser. Or, it could mean those things plus an emergency fund that might be in the checking account, a money market mutual fund, a bank savings account, shorter term CDs, or even an annuity with very little remaining surrender charge.

I'd guess the target allocation to "C" is smaller for someone using the first definition than for someone using the second definition.

You, of course, should use the definition that works for you. It's just a matter of being consistent between the definition you're using, the type of assets you include, and your target allocation.