The bubble skeptics include Yale University economist

Robert Shiller, who won a Nobel Prize in economics in October and has a successful track record of identifying speculative excess in asset prices.

His book "Irrational Exuberance," published at the peak of the dot-com mania, accurately predicted a stock-market collapse. His 2005 update to the book then correctly identified the housing market as being in a speculative boom.

Looking at stocks today, Mr. Shiller puts it this way: "The market is somewhat high, but it's not a time when I would be writing 'Irrational Exuberance.'"

His preferred measure of valuing stocks indicates that stocks are merely expensive, rather than bubbly.

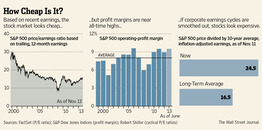

Investors frequently measure stocks' value by dividing their prices by historical or projected company earnings. To smooth out cyclical peaks and troughs in those earnings, Mr. Shiller divides the S&P 500 by the average of the last 10 years' earnings for the index's components after adjusting both for inflation.

Enlarge Image

By that measure, the S&P 500 has a price/earnings ratio of about 24.5, some 48% higher than the 16.5 average for U.S. stocks since 1881.

That might sound high. But before the housing bubble popped, the P/E approached 28—and as the dot-com bubble peaked, the P/E ratio reached 44.

Even though stocks aren't in a bubble, they still are high-priced, Mr. Shiller says. And many analysts and economists, including Mr. Shiller, think small investors could do well to find the places in the market where prices don't look so frothy.