dixonge

Thinks s/he gets paid by the post

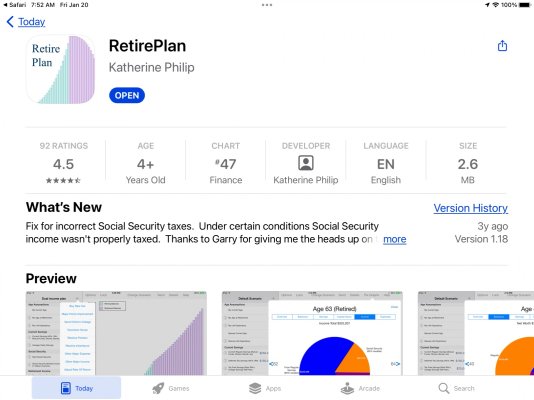

I'm looking for the following:

1. Tax projections that take into account current and future rates (if known), brackets, SS tax, etc. I want to be able to use this to minimize taxes going forward.

2. Input various expected rates of return for portfolio (stocks, i-bonds, etc.)

3. Input various expected inflation rates.

4. Input various budget expense levels and investment contribution amounts

5. RMD's

6. Project all of these forward, comparing different scenarios.

IOW, a fairly comprehensive picture of current state and future projections

I've ready about several products both here and on Bogleheads, both online services and downloadable spreadsheets, but the majority seem to be geared toward helping you figure out when you can retire. I need something for *after* one has retired.

Anyone use something like this? Also I'm not looking at dropping more than $100/yr max for said info...

1. Tax projections that take into account current and future rates (if known), brackets, SS tax, etc. I want to be able to use this to minimize taxes going forward.

2. Input various expected rates of return for portfolio (stocks, i-bonds, etc.)

3. Input various expected inflation rates.

4. Input various budget expense levels and investment contribution amounts

5. RMD's

6. Project all of these forward, comparing different scenarios.

IOW, a fairly comprehensive picture of current state and future projections

I've ready about several products both here and on Bogleheads, both online services and downloadable spreadsheets, but the majority seem to be geared toward helping you figure out when you can retire. I need something for *after* one has retired.

Anyone use something like this? Also I'm not looking at dropping more than $100/yr max for said info...