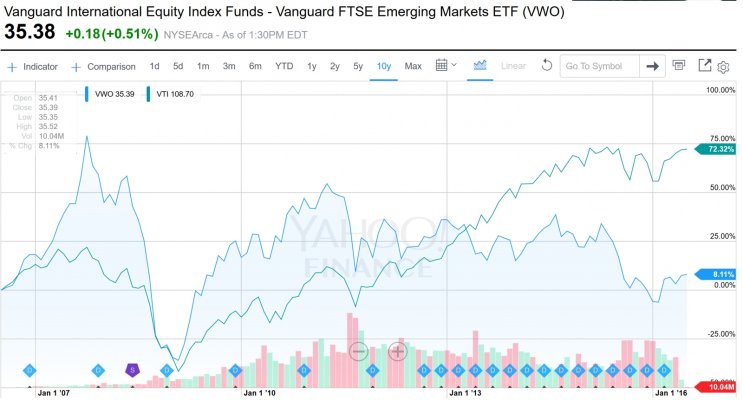

With a low P/E and poor returns the last few years, what does the interested folk think EM will do in the next 10 years? Mean reversion or not?

For sake of simplicity, assume VWO or similar.

[Edit] For sake of discussion: USD nominal returns.

For sake of simplicity, assume VWO or similar.

[Edit] For sake of discussion: USD nominal returns.

Last edited: