Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

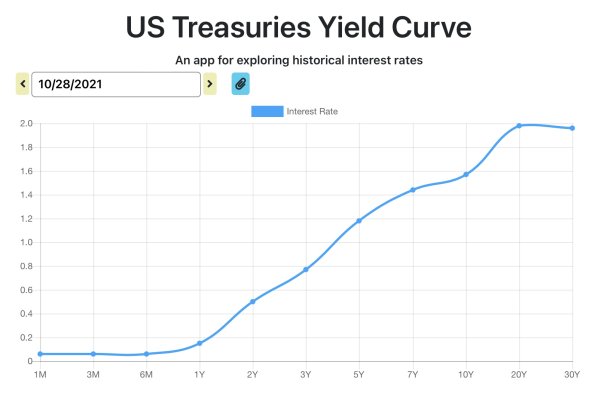

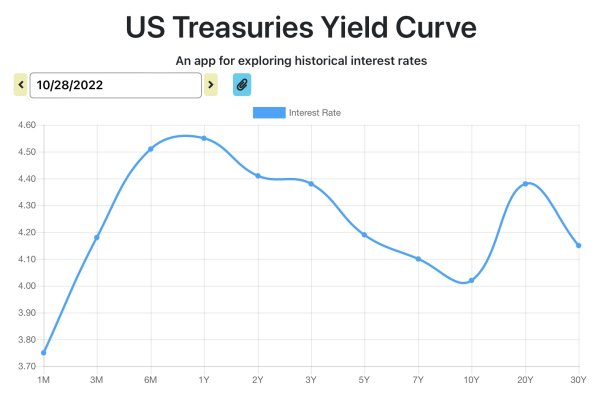

With interest on cash accounts around 2% and interest on T-Bills around 4%, I can't think of any good reason to hold much cash at the moment.

- T-Bills are almost as risk free as cash savings. So almost a wash in terms of safety.

- T-Bills sacrifice a little liquidity - if you want to realize the face value interest.

- T-Bills aren't subject to state or local income taxes, cash savings interest is. Both are subject to Fed taxes, might as well earn more interest with T-Bills.

- T-Bills can be bought with no transactions costs many places.