2HOTinPHX

Full time employment: Posting here.

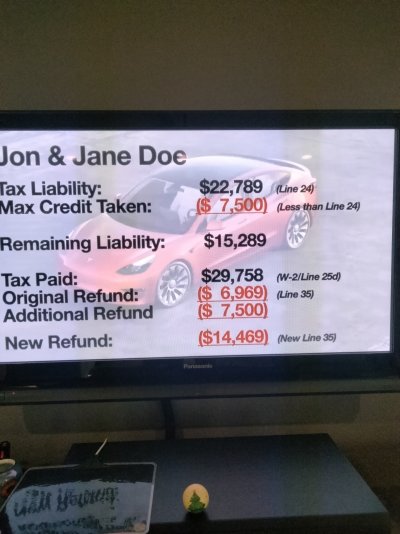

We suddenly find ourselves eligible for the 7500.00 EV tax credit. Our original Chevy Bolt EUV purchased in 2022 was totaled early this month on my way from my last day of work. Rough start to retirement. We replaced it with same just a few days ago.

We do not have enough income to have a tax bill large enough to use the tax credit so we are looking at options to increase income so we do.

We could potentially cash out our I Bonds. We have 2500.00 from 2002 that have accrued 4200.00 in interest. We some recently purchased too we could cash out.

We could also look at a Roth conversion but it seems like we would have to pay estimated taxes by Jan 15 then wait to get those back as a refund on taxes?

Or perhaps a retirement account withdrawal and then reinvest as Roth IRA perhaps?

Maybe need to check with a tax expert?

We do not have enough income to have a tax bill large enough to use the tax credit so we are looking at options to increase income so we do.

We could potentially cash out our I Bonds. We have 2500.00 from 2002 that have accrued 4200.00 in interest. We some recently purchased too we could cash out.

We could also look at a Roth conversion but it seems like we would have to pay estimated taxes by Jan 15 then wait to get those back as a refund on taxes?

Or perhaps a retirement account withdrawal and then reinvest as Roth IRA perhaps?

Maybe need to check with a tax expert?