moneymaker

Recycles dryer sheets

- Joined

- Mar 13, 2013

- Messages

- 106

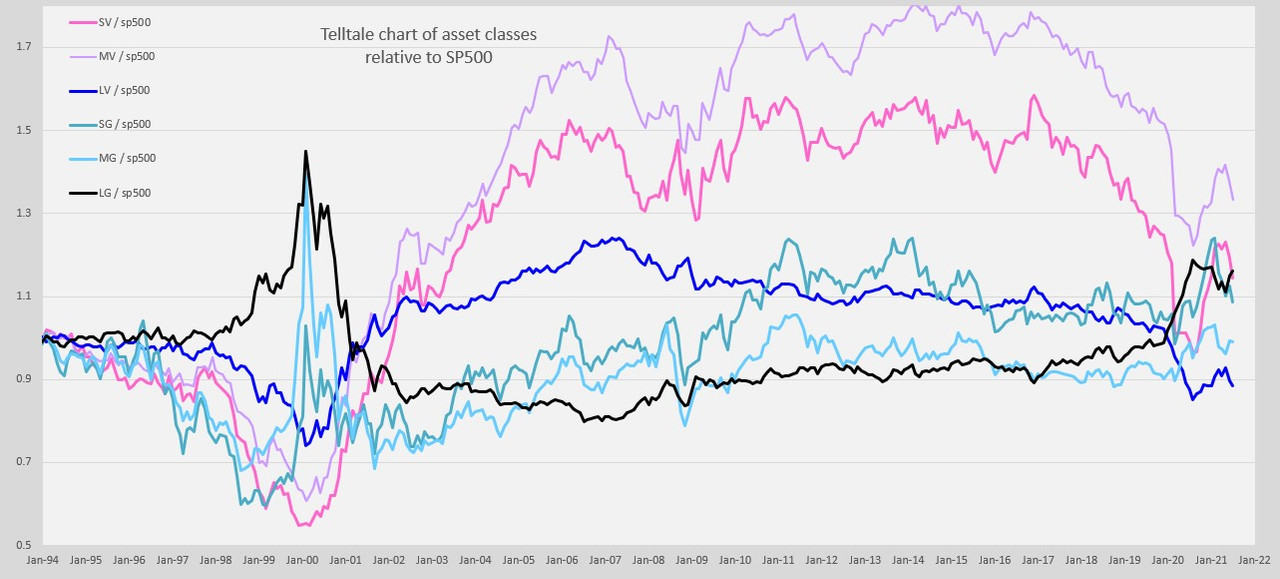

Since late Feb 2021, growth stocks, particularly small and micro cap have gotten crushed. Many down 40-50% from highs. Now from oct 20 to feb 21, they had gotten out of control too so a correction is healthy but we are 6-7 months into this and they are still bleeding out.

I know I hear a lot of folks say it was the shift from growth to value that has been causing this.

Just wondered your thoughts, if anyone has experienced the same, and If anyone that’s lived this before can share some insight into how long these can go on and when some of these small and micro cap stocks may trend up again.

Thanks!

I know I hear a lot of folks say it was the shift from growth to value that has been causing this.

Just wondered your thoughts, if anyone has experienced the same, and If anyone that’s lived this before can share some insight into how long these can go on and when some of these small and micro cap stocks may trend up again.

Thanks!