You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How can new issue have lower yield than coupon?

- Thread starter UpQuark

- Start date

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

If you are talking about notes issued this past week I only see yields higher than the coupon. So these were all auctioned at a small discount. “Interest Rate” = coupon.

| Notes | Reopening | CUSIP | Issue Date | High Yield | Interest Rate | Price per $100 |

| 2-Year | No | 91282CJE2 | 10/31/2023 | 5.055% | 5.000% | $99.896614 |

| 5-Year | No | 91282CJF9 | 10/31/2023 | 4.899% | 4.875% | $99.894701 |

| 7-Year | No | 91282CJG7 | 10/31/2023 | 4.908% | 4.875% | $99.806484 |

Yes, last week's look 'normal' to me, but this upcoming week shows coupons larger than yields, and I don't know how that is possible?

Not sure how to cut/paste neatly, but this is what I see on Fidelity:

Description "Coupon

/Frequency" ExpectedYield

UNITED STATES SER AU-2026 TREASURY NOTE "4.750

semi-annual" 11/15/2026 4.608 Yes 11/07/2023 11/15/2023 CP SFP

UNITED STATES SER F-2033 TREASURY NOTE "4.750

semi-annual" 11/15/2033 4.568 Yes 11/08/2023 11/15/2023 CP SFP

UNITED STATES SER BONDS OF NOVEMBETREASURY "5.000

semi-annual" 11/15/2053 4.765 Yes 11/09/2023 11/15/2023 CP SFP

Not sure how to cut/paste neatly, but this is what I see on Fidelity:

Description "Coupon

/Frequency" ExpectedYield

UNITED STATES SER AU-2026 TREASURY NOTE "4.750

semi-annual" 11/15/2026 4.608 Yes 11/07/2023 11/15/2023 CP SFP

UNITED STATES SER F-2033 TREASURY NOTE "4.750

semi-annual" 11/15/2033 4.568 Yes 11/08/2023 11/15/2023 CP SFP

UNITED STATES SER BONDS OF NOVEMBETREASURY "5.000

semi-annual" 11/15/2053 4.765 Yes 11/09/2023 11/15/2023 CP SFP

Well, since I haven't seen an answer here (perhaps it would have to have been someone here who can remember whenever this last happened which probably was 2007 or some other prehistoric time), I called Fidelity and asked.

Assuming I understood their answer accurately, they try to underestimate yield, the coupon rate could be different, and while the notes might be sold at par it would only be a very slight possibility that they would sell at a premium.

So I guess the answer is that all the numbers are fudgy.

Assuming I understood their answer accurately, they try to underestimate yield, the coupon rate could be different, and while the notes might be sold at par it would only be a very slight possibility that they would sell at a premium.

So I guess the answer is that all the numbers are fudgy.

njhowie

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2012

- Messages

- 3,931

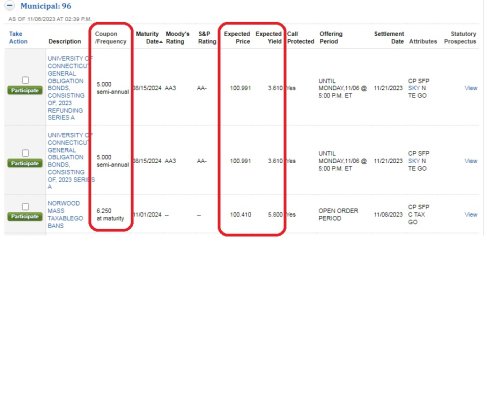

It's very common when yields are up and there is demand for bonds for new issues. Happens all the time with municipal bonds.

They simply have a target yield and price the bonds above 100. So, the coupon can in essence be anything and they can price the bonds to effectively yield anything.

They simply have a target yield and price the bonds above 100. So, the coupon can in essence be anything and they can price the bonds to effectively yield anything.

Attachments

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Well, since I haven't seen an answer here (perhaps it would have to have been someone here who can remember whenever this last happened which probably was 2007 or some other prehistoric time), I called Fidelity and asked.

Assuming I understood their answer accurately, they try to underestimate yield, the coupon rate could be different, and while the notes might be sold at par it would only be a very slight possibility that they would sell at a premium.

So I guess the answer is that all the numbers are fudgy.

You don’t know the yield until after the auction.

Yes, any numbers are fudgy and Fidelity expected yield estimates are unreliable and generally underestimate.

I guess if the coupons are already fixed it could happen after a sudden drop in rates.

These notes/bonds were announced 11/1 and later that same day we had a drop in middle and long rates when Powell signaled a hold.

Last edited:

Similar threads

- Replies

- 35

- Views

- 3K

- Replies

- 3

- Views

- 464

- Replies

- 17

- Views

- 760

- Replies

- 15

- Views

- 532