target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

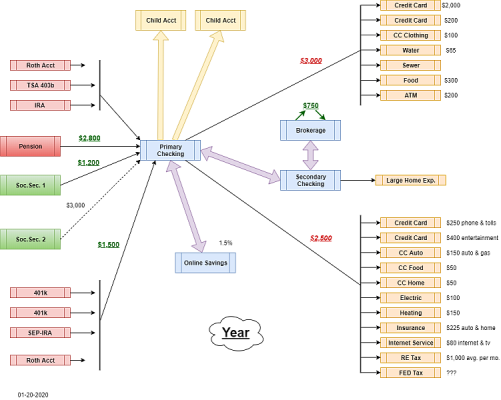

When we took over management of in-laws finances, I made a chart that captured all of their income sources and expenses. This is a cleaner, generalized version.Thank you for the replies.

I have ran my figures through Firecalc as well as a paid and free FPs. They all said we should be go to go.

I might have muddled my question a bit in my rambling.

I am curious about how people decide if they have enough resources to live off of their investments and thus keeping the principal or use a spend down strategy and use up their investments, hopefully on their last day.

We don’t have any heirs, so 1 way doesn’t necessarily have to win out, but there will be a difference in the way we structure our accounts and the investments in them.

Your tax questions are more complicated, but you can see that if you estimate tax impact, then it just becomes another output.

So, add up the income numbers (dividends), and compare to the total of red numbers. That shows you whether you can fund the expenses with just dividends and interest thrown off by the investments.

This can be done in a spreadsheet, too.