lawman

Thinks s/he gets paid by the post

Have began buying individual corporate bonds, C.D.s and treasuries..Have about 20. I always print my confirmation and I keep a file for them. I place them in the order of maturity so that I can easily look and see when my next one will mature. Two questions.

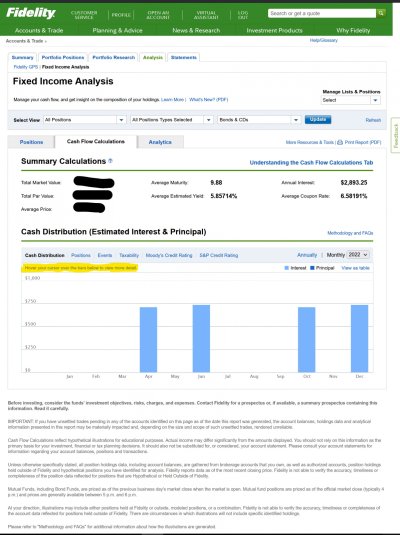

1. How do you know when each one will pay interest?

2. How do you keep up with interest payments to ensure none are missed? (Do I even need to worry about this?)

1. How do you know when each one will pay interest?

2. How do you keep up with interest payments to ensure none are missed? (Do I even need to worry about this?)