prudent_one

Recycles dryer sheets

- Joined

- Jul 30, 2014

- Messages

- 333

I handle finances for a non-profit. Their checking account pays 0.01% APR and the savings account (if we wanted one) pays 0.05% APR. Bank says that's because our account is a business account, not personal.

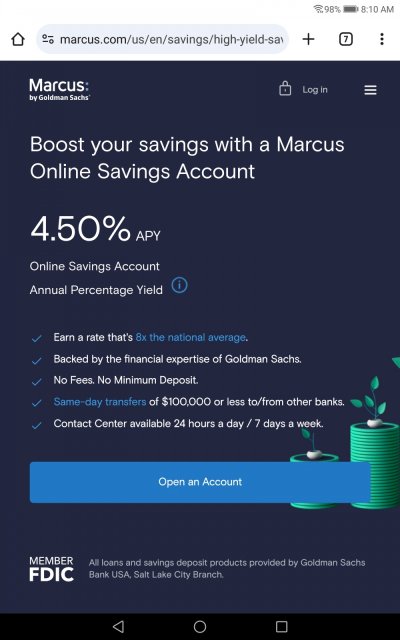

I'm just looking for a way to stretch their funds. Any suggestion how I could find a business bank/credit union savings account (or even a short-term CD) that pays more like the 4%+ personal accounts? Don't want any brokerage stuff as the board of directors would think it's too risky and I don't want to argue with them about it.

Don't know how to search for only business account offers.

I'm just looking for a way to stretch their funds. Any suggestion how I could find a business bank/credit union savings account (or even a short-term CD) that pays more like the 4%+ personal accounts? Don't want any brokerage stuff as the board of directors would think it's too risky and I don't want to argue with them about it.

Don't know how to search for only business account offers.

Last edited: