aja8888

Moderator Emeritus

Anyone who follows the macro economic environment should have a look at Lyn's predictions based on her evaluation of the current world economic situation. There's lots of meat in here and I can't see much fault with her analysis.

https://www.lynalden.com/october-2022-newsletter/

October 2022 Newsletter: Energy vs Sovereign Bond Markets

https://www.lynalden.com/october-2022-newsletter/

October 2022 Newsletter: Energy vs Sovereign Bond Markets

This newsletter issue focuses on recent problems with developed country sovereign bond markets and how energy supply constraints pose an ongoing problem for them.

The Sovereign Bond Bubble

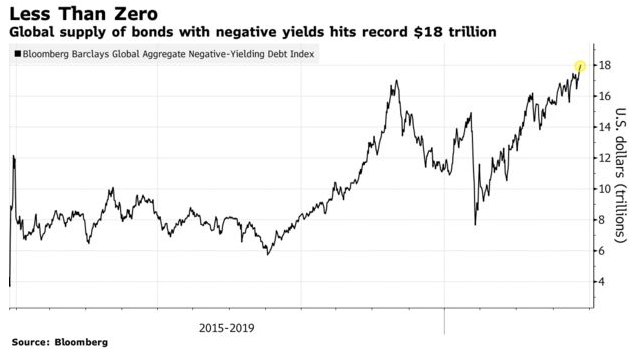

During much of 2019 and 2020, large portions of the developed country bond market were outright negative in nominal terms. Rather than getting paid interest, investors had to pay for the privilege of lending to governments and even some corporations, mainly across Europe.

At its peak, the amount of negative-yielding bonds reached over $18 trillion:

In July 2019, I wrote an article focusing on the high probability that we were in a bond bubble. I opened the article by highlighting that even though I had some concerns about stocks, I was even more concerned about bonds:

I read thousands of emails from my readers, and one of the key themes I see is that people are concerned about the next stock market crash, and perhaps rightly so. By many measures we have high stock valuations in the United States after a decade-long bull market, and we have high corporate debt levels both inside the United States and globally.

But one question I rarely receive is: “Are bonds safe?”

From a historical perspective, the bond market is acting a lot weirder than the stock market at the current time. The stock market looks like it often does at this point in the business cycle, which is not great for the probable range of forward returns, but bonds are doing things they haven’t done ever before in history, which should give investors pause.

Since bonds are traditionally considered the safer asset class, should this be cause for concern? Are we in a bond bubble? Or is this just how things are now? This article examines the issue.

-Lyn Alden, July 2019 “Are We in a Bond Bubble, or is This the New

Normal?“