Markola

Thinks s/he gets paid by the post

I was fooling around on Portfolio Visualizer and stumbled on something pretty remarkable to me, if it is true. It seems that taking a single annual distribution from a portfolio each year to cover living expenses is superior to quarterly or monthly distributions. In my reading about ER, I haven’t encountered this phenomenon before.

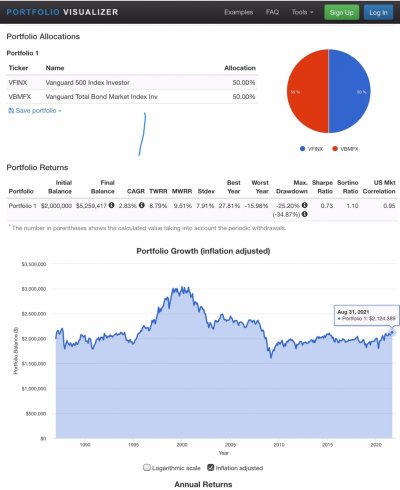

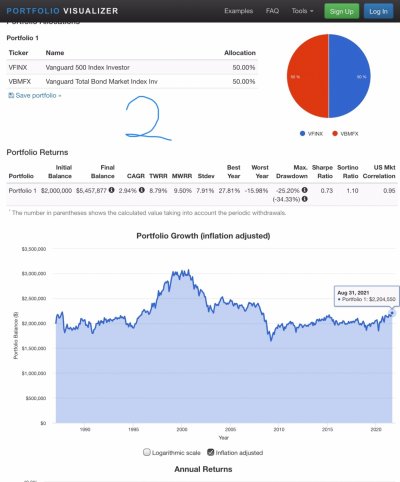

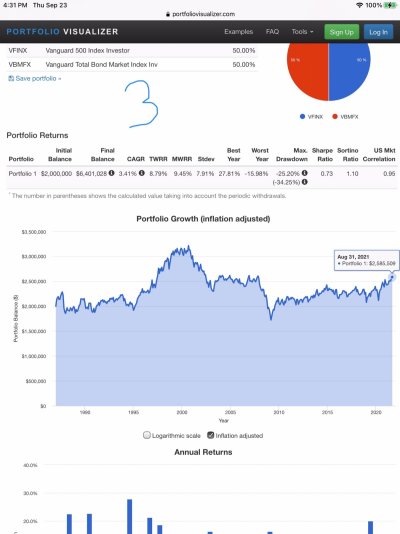

Check these graphs out. Each is for a $2 million 50% stock/50% bond portfolio from which $120,000 with inflationary increases is with drawn each year. I used the oldest data I could on PV but the phenomenon seems to hold no matter what the initial year is.

I wonder if I’m making an embarrassing input mistake or if there is some other kind of error? Intuitively, I would have thought that monthly distributions would be superior to annual, since more money would remain invested longer, or that there would be no significant difference across the three. However, annual distributions outperform. The annual distributions across the three over time grow essentially in tandem, so that’s not it. What do you think is going on here?

1) Monthly distributions of $10,000

2) Quarterly distributions of $30,000

3) Yearly distributions of $120,000

Check these graphs out. Each is for a $2 million 50% stock/50% bond portfolio from which $120,000 with inflationary increases is with drawn each year. I used the oldest data I could on PV but the phenomenon seems to hold no matter what the initial year is.

I wonder if I’m making an embarrassing input mistake or if there is some other kind of error? Intuitively, I would have thought that monthly distributions would be superior to annual, since more money would remain invested longer, or that there would be no significant difference across the three. However, annual distributions outperform. The annual distributions across the three over time grow essentially in tandem, so that’s not it. What do you think is going on here?

1) Monthly distributions of $10,000

2) Quarterly distributions of $30,000

3) Yearly distributions of $120,000