jimbohoward69

Recycles dryer sheets

- Joined

- Feb 25, 2007

- Messages

- 70

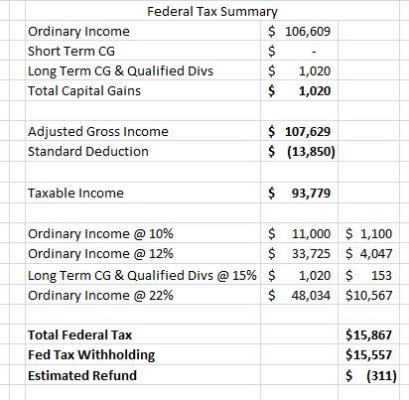

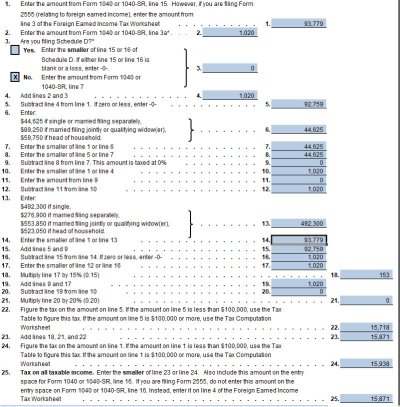

I keep my own financial planning spreadsheet that I update throughout the year. One of the tabs is for tax forecasting, so, when I realize a CG or find out what the div payout will be for a certain company, I update according. Then, at the end of the year, I download a free 1040 spreadsheet to plug in all the numbers.

For some reason, for 2023, my total tax due on the 1040 spreadsheet doesn't match my personal spreadsheet. It's only off by a few dollars but I want to know why. My only entry on the QDCG worksheet is $1,020 in QD for ABT, and the 1040 spreadsheet says I owe $314 whereas my personal one says $311.

Maybe a rounding error? I know this isn't a first world problem, but was just wondering if I'm missing something. I've attached both...maybe someone can see something I'm not.

For some reason, for 2023, my total tax due on the 1040 spreadsheet doesn't match my personal spreadsheet. It's only off by a few dollars but I want to know why. My only entry on the QDCG worksheet is $1,020 in QD for ABT, and the 1040 spreadsheet says I owe $314 whereas my personal one says $311.

Maybe a rounding error? I know this isn't a first world problem, but was just wondering if I'm missing something. I've attached both...maybe someone can see something I'm not.

Attachments

Last edited: