stephenson

Thinks s/he gets paid by the post

- Joined

- Jul 3, 2009

- Messages

- 1,611

Hi All,

Not collecting SS, yet - intent was to wait til 70. Both spouse and I are 67.

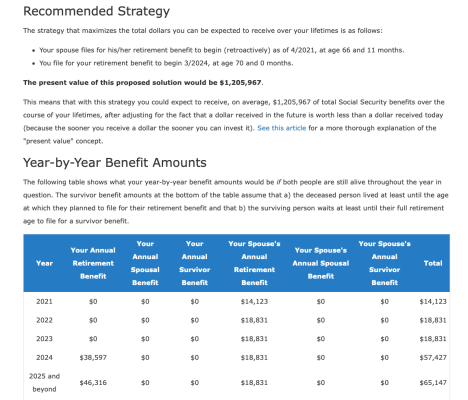

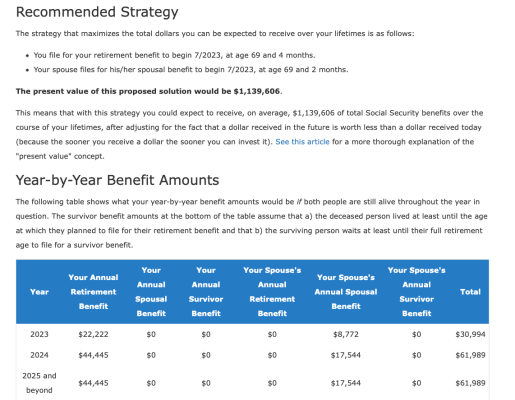

Ran the calculator on opensocialsecurity.com ... screensnap, below.

The PIA number to be entered is the FRA number, not the current or the 70 year number, correct?

Should we have already filed for her spousal?

Thanks!

Not collecting SS, yet - intent was to wait til 70. Both spouse and I are 67.

Ran the calculator on opensocialsecurity.com ... screensnap, below.

The PIA number to be entered is the FRA number, not the current or the 70 year number, correct?

Should we have already filed for her spousal?

Thanks!