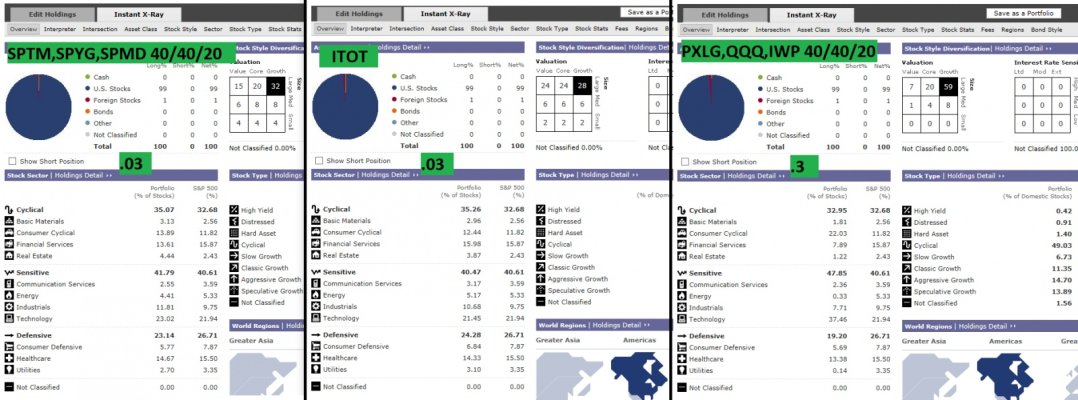

On the "Exposures" index card. Portfolio No. 1 (Total US Market) is a blend of Growth and Value. Portfolio No. 3 is 100% GROWTH.

In the period 2013-2018+, yes, Growth outperformed value. ...

Good point, I compared these in Morningstar X-Ray; maybe it's not absolutely 100% pure growth, but certainly moreso than the others. My intent was more of a spread across mid and small caps. The attachment below shows their current (Feb 2019) breakdown, which I suspect is relatively consistent for the past few years.

As to the other responses, I suppose a take away is that yes anyone can find a period of time that "validates" their argument (and as mentioned, the web is full of "advisers" making their case using credentials of past good luck).

I'm just trying to present a talking point here out of my own naïve curiosity - I'm an engineer and do get statistics; they may be boring and heartless, but (typically) numbers don't lie (unless they're cooked and all that, which there are statistics for that too!). I'm not a finance person, so thanks for the patience

I'm not sure if ER can be treated linearly - as in, a 1% ER of one fund is twice 0.5% ER of another fund. Aren't there other factors like turnover? (or ER by itself might be linear, but other cost factors may influence the "profitability" of a fund?)

Specifically, I was curious in these cases of comparing 0.03% ER with 0.3% ER -- 10X is a pretty wide spread (I think?), that should somehow be noticeable (assuming those backtests are properly accounting for it; which so far everyone seems to agree/assume they are? i.e. ER's change over time, right?).

I'll concede, there are too many other factors for these specific cases.

But I'm not just throwing darts and specific sectors or ETF funds. Actually I did for ARKK, but that's another story - it turned out well for me, but total luck and I'm out of it now. Point here might be that: if it's under 5-10% of your total portfolio, you don't have to stress about ER for relatively short-term "play money" -- if it profits at all, just consider yourself lucky and don't regret about "should have done that instead" possibilities.

To me, it seems there might not be a real standard definition of what "total" means -- "total" could be between 60 to 3000 funds, and is it including non-US? So in that case, a typical casual investor could end up "over-diversified" (if there is such a thing) or "under-diversified". Like anything, there is probably some in-between "sweet spot" (maybe it's the 200-300 spread?). [VUG or similar could be a good match to that -- if available]

So I'm wondering if augmenting "total" with a few (3-8) other options (be them slices of sector specific, or mid/small, or other combinations of "total") might (on the average) end up working out better. I'll call this "cascade", since I don't know how else to search or refer to it as a "strategy". Tentatively, it seems to fill gaps (by weight) that a "total" might have (where 401K's might force a limited spread). This might not be for a young/new investor. And opinions here is the effort isn't worth it (since time spent thinking or agonizing about it is a cost also, away from just enjoying your life).

EDIT: I suppose the industry might refer to these as "All-in-One" portfolios? (except those tend to also include bond portions, right?)

I just wanted to close, that I do think, yes: any investor could probably just pick any "total index" (US-only or total-world) of any ER, let it grow for 40 years, and be ok. Evidence is that there is no "fail" in that. But if the option is available, go for a lower ER and you might just need to sit for 30-35 years instead

[ actually ER alone might not reduce 5 years of grind; point is, investing at all is a good thing towards retirement ]

EDIT: i.e. I don't think there is a case of any investor that profited (by making reasonable selections, not just a single specialized 10-fund ETF hail-mary), but failed to enjoy retirement because of high ER?