So when you say a 29% "tax", you're including the increase in FIT and the decrease in ACA credits?

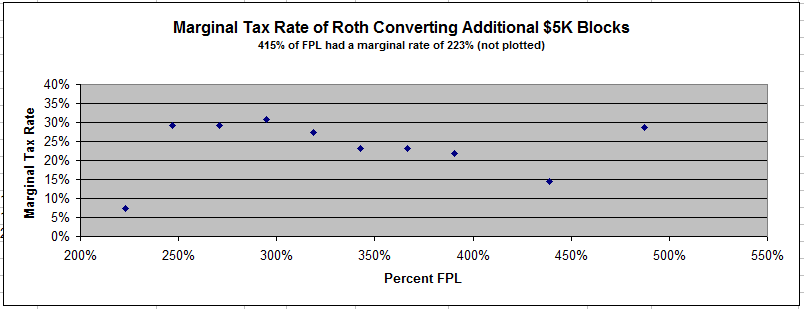

Yes. ACA credits are on the tax forms. It's money exchanged by me and the US Treasury. It's complicated to figure, but if one has anything on one of the two ACA lines of the 1040, that means you're marginal rate is not 0%, 10%, 15%, etc., but some weird other percent....like maybe 29%

Yes, I think I paid 29% my first Roth conversion year and maybe the last couple as well. My calculations said it was worth it to avoid a 25% rate later on, though it was probably very close to a wash.

I have no doubt you've got this nailed for your own situation, so no surprises here for the master modeler!

Just out of curiosity, what is the tax rate from 223% FPL to the top of the 15% tax bracket?

Roughly 45%. That includes the 'cliff', of course. That's going from about 20K to 70K taxable income, and going from about 50K conversion to 100K conversion. Converting that last 50K adds 22.5K to my bottom line (in lost credits and additional taxes).

I assume you hit the point where you filled the 15% rate and for each additional dollar added, started pushing a dollar qualified dividends or LTCGs into 15% taxable, for a 30% marginal rate. I call this the phantom 30% bracket that falls in between 15% and 25%. 30% continues until you've made all your divs/LTCGs taxable, at which point conversions fall into the 25% tax bracket.

That's a different animal. What I'm talking about happens at lower AGI's and has nothing to do with gapital gains.

There is no "29% bracket"....The effect of the ACA subsidy, which is going to be unique for you. Or at least not standard for everyone.

I seem to have found myself in a 29% bracket, but yes, I made no claim that others' would be exactly like me. The calculation is complicated, having to do with the cost of the second lowest silver plan, and that changes county-by-county. The point I was attempting to make was if you are getting a PPACA subsidy, you might be wise to figure out what your actual marginal "tax rate" is, not based on where your taxable income is looked-up in the tax table, but rather on the sum of the very bottom line of your 1040 plus advanced PTC.

Run your scenarios in increments of $1000 rather than $5000 in that range, than $100 and down to $1 to see this. You'll probably want to do this anyway to see exactly where the cutoff is, to avoid the 30% marginal jump.

I was manually keying this into the Block tax software, so it was labor intensive even to do at 5K increments.

I haven't looked at subsidy and tax rate verse %FPL, but from your description , this is below the cliff. If one assumes family size of 2... you are well below the MAGI for the cliff and the top of the 15% bracket.

True that. My example is a family size of 3, so even more so.

One question, in your modeling, were you including estimated Qdivs and LTCG or just all as ordinary income?

Almost everything I have is in tax advantaged accounts, so my example isn't affected by the favorable treatment of qualified dividends or long term capital gains.

Yep, it's probably a good idea to stay well clear of the cliff, ...

That's something I kinda had drilled into me from hanging out here

The new bit, at least for me, is that converting past a point where the subsidy gets impacted is just not a smart idea, given that I should be able to get most of my money out of tax advantaged accounts at 15%, or maybe a little 25%. So paying 29% is hard to justify only on the tax-free growth of the Roth money.