So my CD renewed today at 1.01%. I can't take it. These CD rates the past few years I can't get ahead with these low rates. I'm retired at late 50's. No pension. Just my savings. I don't see the rate going up anytime soon, it looks like at least a couple of years of waiting.

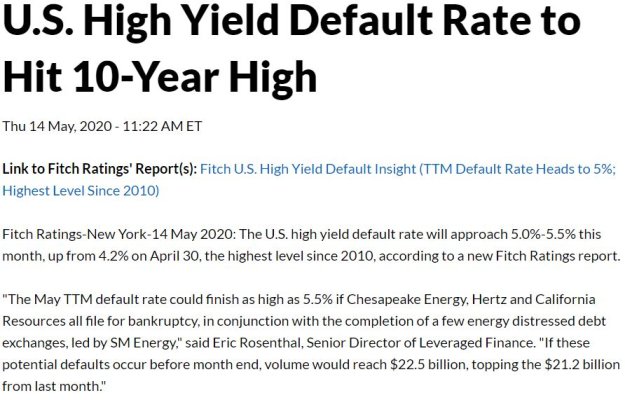

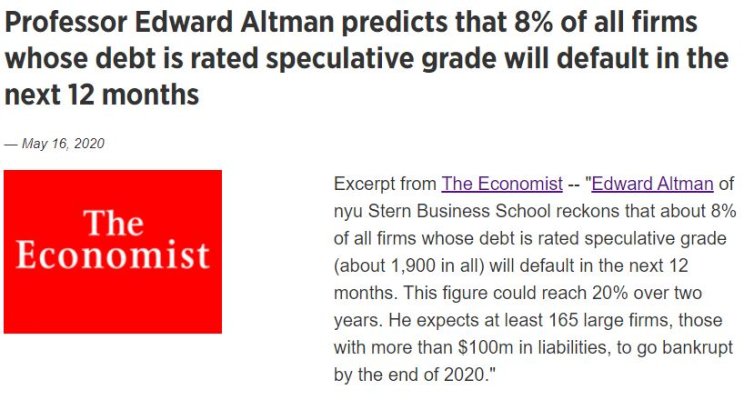

Would it be reasonable to invest in some high yield bond funds paying around 5%. I currently have a couple that have been paying around 5.5% but the value has gone down a full point since I bought them several years ago.

Would it be reasonable to invest in some high yield bond funds paying around 5%. I currently have a couple that have been paying around 5.5% but the value has gone down a full point since I bought them several years ago.